Is it too late to buy lithium stocks?

Is the ASX lithium boom over?

These questions are becoming more common.

Why?

After a false dawn in 2018, the lithium sector is going through a resurgence hard to ignore.

In fact, you could argue that lithium was the hottest investment theme of 2021.

After all, eight of the 10 top performing stocks on the All Ordinaries in 2021 were lithium stocks.

Source: Airlie Funds Management

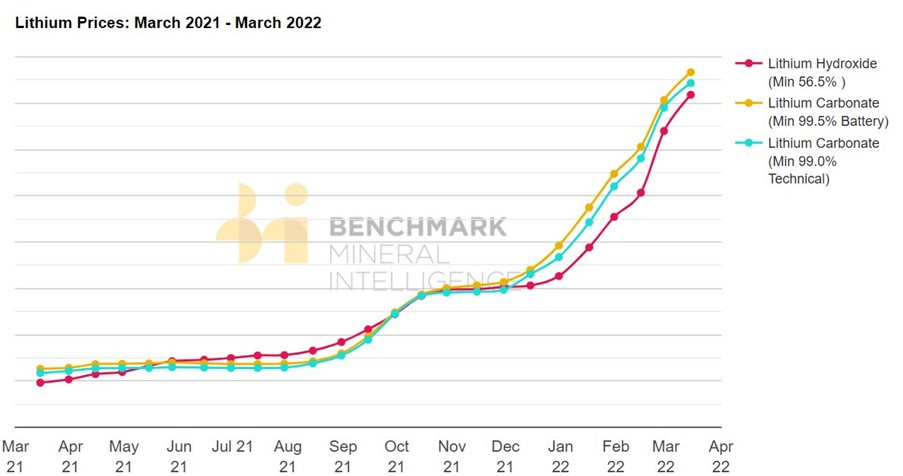

And while ASX lithium stocks soared in 2021, so too did lithium prices.

Source: Benchmark Mineral Intelligence

It’s quite a turnaround.

As The Australian Financial Review reported:

‘Lithium was for decades discarded, or at best sold as a low-value by-product from the numerous tantalum mines scattered across Australia’s western flank.’

And it was as recently as December 2015 that mining veteran Mark Calderwood rejected a broker’s overtures to find a lithium project, claiming ‘No, there can’t be any money in lithium.’

Of course, a few years later, Calderwood realised his mistake and got involved in lithium mining.

Lithium stocks hit mainstream

But while it was easy to overlook the potency of lithium’s potential 5–10 years ago, it’s almost impossible now.

Lithium is mainstream.

Analysis from BDO found that lithium projects attracted more funding than any other commodity over the past year.

That’s right — lithium investment surpassed even investment in gold, the stalwart metal of Australia’s exploration sector for over 150 years.

But this leads us back to the question that kickstarted this piece.

Given the mainstream interest — both from investors and miners — is it too late to invest in lithium stocks?

Has the ship sailed?

Easy money in lithium is over…so be picky

As we’ve written in our latest lithium research report, the lithium boom isn’t over, but the easy money is.

Last year the surging tide of interest in lithium lifted plenty of lithium stocks.

This year, you must be pickier.

The investors who’ll continue riding the lithium wave in the next few years will be the ones with a more selective eye.

Indiscriminate buying won’t suffice anymore.

This doesn’t mean taking some money off the table so much as parking it in top stocks that have more going for them than simply being in the lithium industry.

Because we have to ask ourselves this.

Does the wider lithium story still hold?

Definitely.

In the first month of 2022, prices for lithium-rich spodumene concentrate rose 45.5%. That’s 45.5% in one month.

Lithium prices are nearly 480% higher compared to January 2021 and almost six-times higher compared to September 2020.

But as we argue in the research report, many hot lithium stocks of 2021 are not set to commence commercial production for years.

Some are looking to start production as far back as 2027.

That’s a while away and — crucially — could come at a time when supply catches demand.

So the stocks best-placed to benefit from current rising lithium prices are the stocks capable of shipping lithium now.

Three overlooked lithium stocks for you to look at

But what are these stocks capable of shipping lithium right now and benefiting from strong market conditions?

We identified three such stocks in the research report you can download and read today.

Consensus analyst forecasts have the first stock making $1.16 billion in revenue in FY22 and $1.88 billion in FY23.

Consensus analyst forecasts have the second stock raising its FY22 revenue from $784 million to $1.52 billion in FY24.

And the final stock was dubbed by investment bank JPMorgan a as a ‘one-stop stock for EV raw material.’