Today Lake Resources [ASX:LKE] announced its second non-binding MoU of 2022, this time with auto giant Ford Motor Company.

LKE shares rose as much as 16% in morning trade on the news.

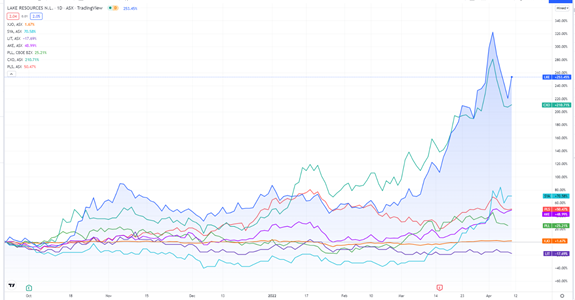

Reaffirming the strength of the lithium theme, LKE is up over 500% in the last 12 months alone, although the stock is down 20% from its all-time high recorded last week.

The ASX lithium theme rages on, but for how long?

Source: Tradingview.com

LKE’s tentative deal with Ford

Lake Resources’ memorandum of understanding (MoU) with Ford consists of a proposed offtake totalling 25,000 tonnes per year of lithium sourced from LKE’s Kachi project in Argentina.

This MoU announcement comes after Lake’s March announcement detailing the collaboration with Hanwa to create a Clean Lithium Supply Chain for electric vehicles.

Lake believes the MoU with Ford will further reduce project risks.

As LKE chairman Stu Crow explained:

‘This MoU with Ford follows the Hanwa MoU. Together with the UK and Canada Export Credit Agencies’ indicative provision of debt finance for around 70 percent of the Kachi project’s capital requirements, this provides a framework of support for Lake’s TARGET 100 Program, which has the goal of producing annually 100,000 tonnes of high purity lithium chemical to market by 2030.’

While the agreement is a positive development, it is not binding at this stage.

Both Ford and LKE see this initial MoU as an ‘opportunity for a potential long-term agreement with the ability to scale up environmentally responsible production and participate in Lake’s other projects to ensure high-quality lithium products are available to Ford.’

In its half-yearly accounts released last month, LKE reported having $71 million in cash, having raised over $50 million during the period via capital raises.

Automakers on the hunt for white gold

In March, Ford announced that it would increase spending on electric vehicles (EVs) from US$30 billion to US$50 billion through 2026.

Ford’s CEO, Jim Farley, said the automaker plans to build over two million EVs in 2026, which would account for a third of Ford’s annual production.

Ford aims to have EVs comprise 50% of its total sales volume by 2030.

The ambitious targets mean Ford is on the market for plenty of lithium. But with supply still tight, it will be competing with the likes of Tesla for access to the white metal.

That’s not lost on Lisa Drake, Ford’s vice president of EV industrialisation. Drake said the deal with LKE reflects Ford’s drive to secure lithium inputs:

‘As we’ve shared, Ford is sourcing deeper into the battery supply chain. This is one of several agreements we’re exploring to help us secure raw materials to support our aggressive EV acceleration.’

Lake Resources’ share price outlook

LKE’s MoUs with Hanwa and Ford are encouraging and showcase how hot the lithium market is.

With automakers like Ford pivoting hard to EVs, lithium will be in high demand as a key input for batteries.

But the high demand is also forcing automakers to scramble to secure supply — even if it means lining up deals with lithium developers still years away from production.

That’s good for Lake Resources. But how good will depend on how sticky these agreements turn out to be.

Can LKE turn its deal with Ford into something binding?

Time will tell.

In the meantime, if you are interested in lithium stocks, you may want to read Money Morning’s latest research report identifying three overlooked stocks in the sector.

Access the report — freely available — here.

Regards,

Kiryll Prakapenka,

For Money Morning