Graphite miner Syrah Resources [ASX:SYR] announced that the US government has conditionally committed to lend it up to US$107 million to develop an active anode material (AAM) facility in Louisiana.

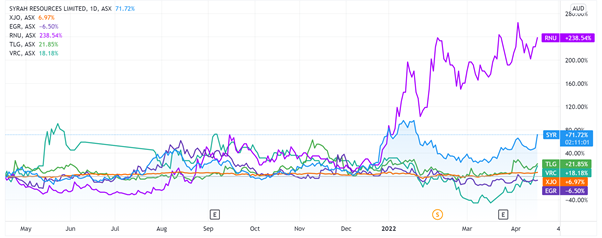

SYR shares rose as much as 20% on the news and are up 70% in the last 12 months.

The US government loan agreement comes after Syrah entered a supply deal with EV giant Tesla last December.

Source: Tradingview.com

Syrah announces US$107 million loan

After an ‘extensive approvals process’ initiated in June 2021, Syrah has finalised a non-binding term sheet and was offered a conditional commitment for US$107 million by the US Department of Energy (DOE).

The proposed loan is set to run for up to 10 years, with interest on the loan to be fixed from the date of advance for the loan ‘at applicable long-dated US Treasury rates.’

The loan will fund the expansion of SYR’s Vidalia AAM facility in Louisiana to 11,250 tonnes per annum AAM production capacity.

The proposed loan is made under the DOE’s Advanced Technology Vehicles Manufacturing (ATVM) loan program.

The program aims to support US President Biden’s ambition to manufacture EVs and battery tech materials in the US.

Syrah reported the DOE possesses US$17.7 billion in uncommitted loan authority under the ATVM program.

Syrah thinks it is a natural fit for the loan program, stating it seeks to develop a vertically integrated natural graphite AAM supply option in the US.

According to Syrah, if the loan is finalised, it will be the first ever ATVM loan approved to a materials processing facility and the first ATVM loan since 2011.

Other loan recipients include Ford, Nissan, and Tesla.

Jigar Shah, DOE’s Loan Programs Director, commented:

‘The Conditional Commitment offered to Syrah would be for the first ever ATVM loan to support a supply chain manufacturing project and further demonstrates DOE’s commitment to building a strong domestic supply chain for zero emission transportation solutions.

‘This reiterates President Biden’s commitment to strengthening US critical mineral supply chains and growing the US workforce to support domestic battery manufacturing for EVs. Moreover, the Vidalia Initial Expansion project provides a socially and environmentally responsible US supply chain for graphite, which is critical to accelerating the deployment of batteries to power EVs.’

Source: Tradingview.com

Syrah Resources share price outlook

Syrah and the DOE are targeting the financial close of the loan by the end of June 2022 and the first advance of the loan in the September 2022 quarter.

Syrah’s CEO Shaun Verner said:

‘The finalisation of a term sheet and offer of a Conditional Commitment from DOE for a loan under the ATVM program highlights Vidalia’s strategic position in the USA and provides strong validation of Syrah, Vidalia and the Vidalia Initial Expansion. Importantly, the loan will allow Syrah to accelerate its growth strategy in its downstream business and support the rapidly growing EV and battery supply chain in the USA.’

However, there are a few caveats.

Today’s announcement refers to a conditional commitment on DOE’s part.

A conditional commitment is offered prior to a loan issue and indicates that the DOE ‘expects to support the Vidalia project, subject to the satisfaction of certain conditions.’

Syrah’s announcement did acknowledge that at this stage there is ‘there is no certainty that a loan financing from DOE will be ultimately committed to Syrah Technologies, or if committed, on terms and conditions consistent with the term sheet.’

In 2018, outlet Ars Technica wrote:

‘In nearly a decade of operation, the ATVM program has issued just five loans—and none at all since 2011. Some electric vehicle (EV) start-ups are still waiting for a decision on loan applications filed in 2009 and 2010.’

Yet, despite being non-binding, today’s announcement shows that Syrah is getting noticed.

Syrah has a large graphite mine — a key input for battery technology.

And it’s developing a vertically integrated processing facility in the US, one of the largest consumer markets, presided over by an EV-friendly administration.

Syrah is in a good position, but now is the time for execution.

And while lithium has taken most of the limelight, the EV revolution cannot happen without lithium’s other siblings — copper, nickel, cobalt, and of course, graphite.

In 2021, eight of the top 10 best-performing stocks in Australia were lithium stocks.

But according to Money Morning’s latest report, there’s a smarter way to play the rise of lithium in 2022.

It involves what you might call lithium’s ‘little brother’.

Access the ‘The NEXT Lithium?’ report here to find out more.

Regards,

Kiryll Prakapenka,

For Money Morning