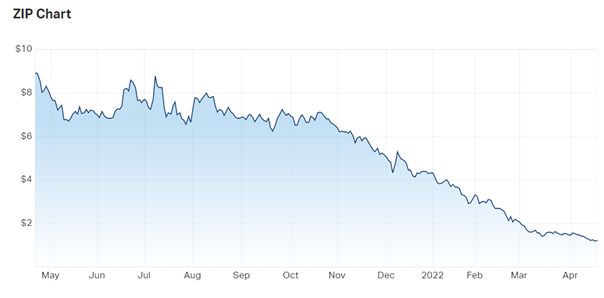

Zip Co [ASX:ZIP] hit a new 52-week low on Thursday as the BNPL stock released its March quarter results.

Zip — who changed its stock ticker to ZIP overnight from Z1P— was trading as low as $1.205 a share in morning trade, a new low.

ZIP shares are down a substantial 85% in the last 12 months, in what has been a dour period for BNPL stocks and the tech sector generally.

Overnight, barometric US tech stock Netflix crashed 35%.

Source: Marketindex.com.au

ZIP’s familiar tale in March quarter

It was a familiar tale with ZIP’s latest quarterly release — top-line growth mixed with problematic bad debts.

Let’s consider the top-line highlights first.

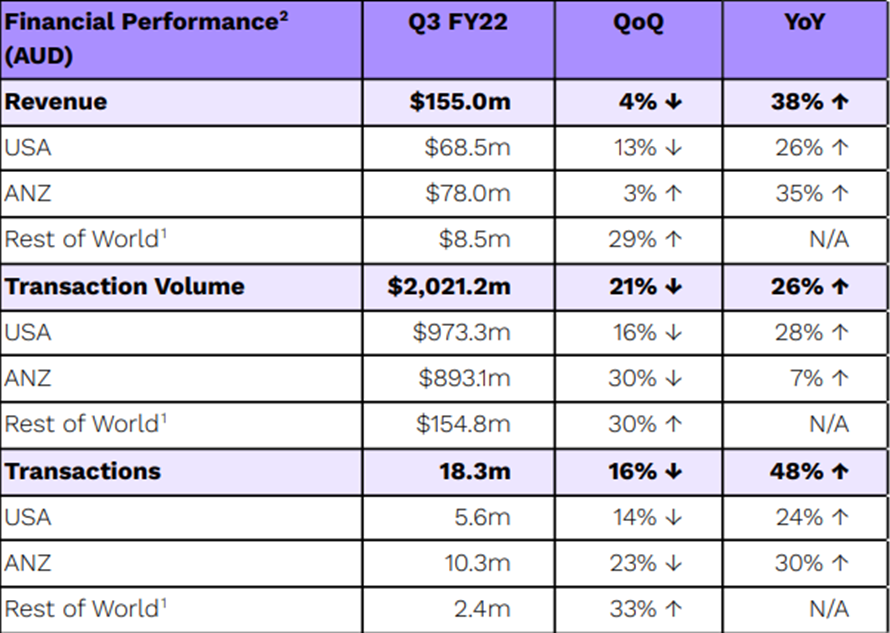

Quarterly revenue rose 39% year on year, totalling $159.2 million, despite Zip saying March is a weak seasonal quarter.

Breaking down the revenue, the USA segment contributed $68.5 million, ANZ contributed $78 million, and the rest of the world made up $8.5 million.

Transaction volume rose 27% year on year to $2.1 billion.

Total transaction numbers reached 18.3 million for the quarter, up 48% YoY.

Customers rose to 11.4 million, up 78% YoY.

Merchants are now at 86,200, a 90% YoY increase.

ZIP’s YoY growth not the whole story

However, the YoY growth doesn’t tell the whole story.

Quarter-on-quarter numbers fill out a more complete picture. What does it say?

ZIP’s revenue fell 4% QoQ.

Importantly, the vital USA growth market saw revenue fall 13% QoQ.

But the biggest QoQ falls were in total transaction volume and total transactions, which sunk 21% and 16% respectively.

While customers did rise 15% on the preceding quarter, Zip’s ‘Rest of the World’ segment did the heavy lifting, posting a 42% growth in customers.

Solidifying the pattern of maturity, customer growth in the ANZ segment was 3% QoQ:

Source: ZIP

ZIP’s unit economics and cutting ‘people costs’

ZIP said its cash transaction margins reached 2.3%, up on last year’s 2.1%.

However, the BNPL stock expects ‘H2 credit losses to remain at similar levels to H1 (c. 2.6%), as losses from volume written in H1 are realised’.

The BNPL provider cited both internal and external factors in credit losses being outside the target range.

With credit losses expected to be largely unmoved in H2, ZIP is turning to other avenues to cut costs: staff.

ZIP today announced it expects to decrease ‘global people costs by approximately $30m+ in FY23’.

Unfortunately, next year Zip intends to reduce global ‘people cost base’ by $30 million.

We will be seeing quite a few job losses as a result.

Other counter-loss changes will include new learning models, target-level optimisation and diagnostic analysis in the US, and portfolio revision and risk-setting adjustments in Australia.

What next for ZIP?

Zip reported that $172.7 million has been raised though institution placement and share purchases.

Zip now has $303.4in both ready cash and liquidity.

Zip CEO, Larry Diamond, said:

‘In the half year results we acknowledged a change in external factors and announced several adjustments to our strategy — with a refined focus on sustainable growth, strong unit economics and fast tracking profitability. The quarter saw us continue to deliver top line growth and strong revenue margins, while beginning to implement this refreshed strategy.

‘The Sezzle acquisition remains on track and will deliver significant scale and synergies, directly supporting our objective of accelerating and winning in our core US market, and building a profitable business at scale. Our merchant pipeline is exceptionally healthy and we look forward to welcoming game changing merchants to the platform in Q4.

‘The underlying business remains strong, we are well funded and positioned to execute on the significant market opportunity as we aim to take control of our future. We are well on our way to disrupting the unfair and broken credit card, with a better and fairer digital alternative for the customer of tomorrow.’

As fintech stocks continue to slide as monetary policies tighten and investors flock to hard assets, where are the new growth opportunities?

Are they even out there?

Our analysts at Money Morning think so.

In fact, they’ve focused on the burgeoning opportunities made possible by the metaverse.

Are you sceptical about the metaverse and its opportunities?

Then I suggest you read our latest research report, which is pitched as a sceptic’s guide to the new virtual world that we may all be frequenting soon.

Read the report here, for free.

Regards,

Kiryll Prakapenka,

For Money Morning