Sayona Mining [ASX:SYA] is down 3% today after striking a new lithium pegmatite discovery at its Moblan Project.

At the start of April, SYA set a new 52-week high when its Authier project spodumene testing yielded positive results.

But the company is trading 10% off its recent 52-week peak.

Despite today’s fall, the lithium stock is up over 800% in the last 12 months:

Source: TradingView.com

Sayona’s new lithium discovery

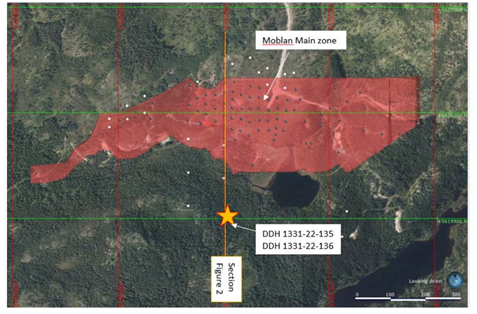

This morning, Sayona announced the discovery of a ‘significant new lithium pegmatite’ at its Moblan Project.

SYA said the highlights included:

‘5m @ 1.85% Li2O from 3.5m and 35m @ 1.62% Li2O from 27.6m in hole DDH135 together with 6.6m @ 1.69% Li2O from 2.1m and 27.2m @ 1.53% Li2O from 22.0m in hole DDH136.’

Lithium minerals have been discovered 200 metres from the main Moblan deposit, with lithium yields from 5–35 metres deep into deposits.

With the project now finalised, the company owns 60% interest in this area.

Sayona said the results suggest potential for a northern hub to be added to the Abitibi site in North America for lithium spodumene resource expansion.

Results for other surrounding drill holes are pending, with a follow‐up drilling program soon to be executed.

SYA Managing Director, Brett Lynch said:

‘These results are excellent, demonstrating the quality of the Moblan Lithium Project and highlighting the potential for a significant resource expansion. Moblan is set to form the basis of a major northern hub for Sayona in Québec, complementing our established Abitibi lithium hub in the south and adding to our position as holding the leading lithium resource base in North America.’

Source: Sayona Mining

Sayona took the opportunity to report its commitment to enlisting local communities for the project in pursuit of stakeholder engagement.

SYA had also recently announced that its flagship North American Lithium and Authier projects produce resources that are JORC-approved to 119.1 million tonnes.

SYA mentioned analyst Benchmark Mineral Intelligence believes existing lithium capacity has doubled since 2021, which subsequently challenges Elon Musk’s claim that supplies have become the ‘limiting factor’ for electric vehicles.

Benchmark lithium prices were listed as being up 487% year‐on‐year.

Sayona share price: what next for lithium stocks in 2022?

The rapid rise of lithium stocks like Sayona invite plenty of questions.

Chief among them is how long can these lithium stocks outperform the market?

The market is forward-thinking. So how much growth is already priced in?

After all, being the dominant story, lithium is no longer a fringe theme set for a rerate. Lithium is mainstream news.

Given this, should we expect lithium to rollick higher in 2022? Or will the share prices of Sayona and Lake Resources [ASX:LKE] stabilise?

SYA shares, for instance, are 10% off their 52-week peak.

LKE shares, on the other hand, are 20% off their 52-week high.

Is there now a better way to play the lithium theme than investing in lithium stocks?

Maybe.

According to Money Morning’s latest report, there’s a smarter way to play the rise of lithium in 2022.

It involves what you might call lithium’s ‘little brother’.

Click here to access the ‘The NEXT Lithium?’ report to find out more.

Regards,

Kiryll Prakapenka,

For Money Morning