Online fashion retailer Cettire [ASX:CTT] rose as high as 19% Thursday morning before retracing and falling 7% in the afternoon on a March quarter-trading update.

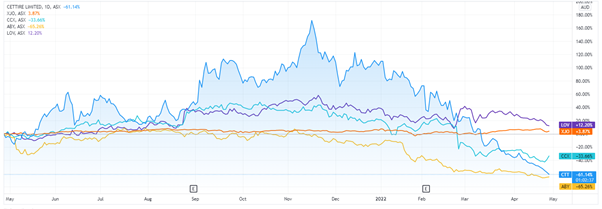

The intraday volatility echoes Cettire’s year-long turbulence.

Having traded as high as $4.8 a share last November, CTT shares now trade at 68 cents.

The company’s share price is down 60% in the last 12 months.

Source: TradingView.com

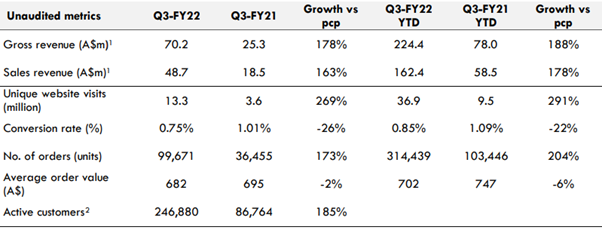

Cettire’s quarter by the numbers

Here are the key (unaudited) figures from Cettire’s trading update for the March quarter.

CTT recorded gross revenue of $70 million in Q3 FY22, up 178% on the prior corresponding period.

Unique website visits were up 269%, totalling 13.3 million.

The spike in website visits led to the number of orders rising 173% to 99,671.

Active customers at the end of the March quarter totalled 246,880, up 185% on the prior corresponding quarter.

Source: Cettire

However, the growth wasn’t all good news.

Cettire’s conversation rate — no doubt partly due to soaring website traffic — dropped from 1.01% to 0.75%.

The average order value also fell 2% in the quarter.

Further, CTT continues to have a problem with a widening discrepancy between gross revenue and sales revenue.

In Q3 FY21, sales revenue was 73% of gross revenue.

In Q3 FY22, however, sales revenue was 69% of gross revenue.

Cettire launches mobile applications

Cettire reported that its customers can now download Android and iOS mobile apps, move designed to reach a wider market and improve shopping experience.

Using these apps will mean customers can browse the Cettire catalogue on their phones with access to ‘checkouts’ and ‘wishlists’.

Cettire reported that 80% of its website traffic has come from mobile usage.

CTT founder and CEO Dean Mintz said of the mobile app:

‘The launch of our mobile app represents a key milestone in the execution of our growth strategy and further extends our proprietary technology platform, whilst enhancing brand and customer experience.

‘Mobile applications are a critical component of our growth strategy to acquire new customers, increase conversion rates and improve retention.

‘While the majority of our traffic is already mobile and our website is mobile-optimised, our apps enable a more seamless engagement with customers and provide considerable scope for an even greater personalised experience.

‘In the early stages post-release, we are experiencing higher conversion rates and higher AOV for on-app purchases versus other channels.’

CTT share price outlook

CEO, Dean Mintz, offered his take on Cettire’s performance:

‘Our business continued to grow very strongly through Q3, driven by increased site traffic, substantially higher active customer numbers and repeat purchasers, which represented more than 50% of gross revenues in the quarter.

‘We have driven improved marketing efficiency and conversion as we exited the quarter, leveraging our proprietary storefront software and new mobile applications.’

Now, while Cettire has been a turbulent stock — and is now down 60% in the last 12 months — the ASX has other stocks to consider.

While sell-offs in growth stocks may make some leery, it’s important to remember that the ASX is not a stock market but a market of stocks.

So what are some stocks primed for potential success in 2022 and beyond?

There are plenty of stocks are out there with technological and innovative ideas that could bring in millions.

If you’re interested in finding out what some of those are, check out this free report on seven stocks to watch like a hawk.

Regards,

Kiryll Prakapenka,

For Money Morning