Australian bookmaker PointsBet Holdings [ASX:PBH] surged 10.70% today, lifting itself from a 52-week low.

Today’s rise in shares is respite for PBH shares, which have been in a protracted slide this year.

Over the last 12 months, PBH is down 75%.

Source: Tradingview.com

PointsBet March quarter: Growth at a cash cost

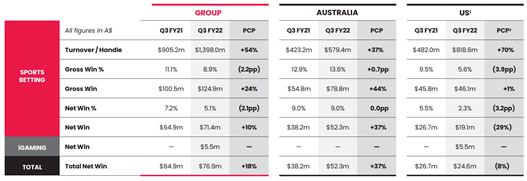

PoinstBet recorded wagering turnover of $1.4 billion, up 54% on Q3 FY21.

Australian turnover hit $579.4 million, 37% higher than the prior corresponding quarter.

The US segment’s turnover reached $818.6 million, a 70% increase.

The big jump in US turnover highlights why PBH is so focused on growing its market share there.

Despite overall turnover rising 54%, PBH’s total net win amount rose only 10%.

This was because PointsBet’s net win percentage shrunk from 7.2% in Q3 FY21 to 5.1% in Q3 FY22.

As PointsBet explains:

‘Net Win is the dollar amount received from clients who placed losing bets less the dollar amount paid to clients who placed winning bets, less client promotional costs (the costs incurred to acquire and retain clients through bonus bets, money back offers, early payouts and enhanced pricing initiatives).’

No doubt promotional costs played a part in the lower net win percentage.

For the quarter, PBH spent $53.7 million on marketing on $77.9 million in cash receipts.

PointsBet spent a further $51 million on product manufacturing and operating costs.

The big spending saw the company register a net operating cash loss of $58.5 million.

Year to date (nine months), PointsBet’s operating cash outflows now total $136.8 million.

Source: PBH

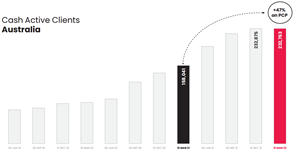

In Australia, cash-active clients grew 47% over the last 12 months, with 232,763 total clients. Marketing in Australia has cost the company $7.1million.

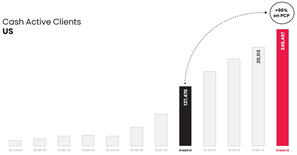

North American cash-active clients rose 96%, with a total of 249,497 clientele. Marketing in the US has cost PBH US$33.2million.

Source: PBH

PBH share price outlook

PointsBet reported that it recently won the top sports betting operator 2022 award in North America.

At the EGR Operator Awards, Pointsbet’s US CEO Johnny Aitken said:

‘Being recognized for the second consecutive year as the top sports betting operator at the EGR North America Awards is a tremendous honour…We extend our sincere thanks to the judges, sponsors, industry colleagues, and entire EGR team for the recognition and validation of our hard work in the past year, which featured PointsBet extending its operations further across North America to jurisdictions like New York, Pennsylvania, and Ontario. Looking at the opportunity ahead, we are excited to continue proving our vision and ability to execute.’

While awards such as these suggest PointsBet offers a product that resonates with users, it must also focus on how to turn recognition of its products into profit.

PointsBet may win the award next year…and the year after that…but it can’t burn cash forever.

The sports gambling industry was estimated to be worth around $211 billion in 2021, with the Asia-Pacific region taking a 49% lead in the global market.

Can PBH turn the growing wagering market into positive cash flow?

Time will tell.

Now, despite PBH’s recent slide, there are plenty of other stocks out there with technological and innovative ideas operating in growing markets.

If you’re interested in finding out what some of those are, check out this free report on seven stocks to watch like a hawk.

Regards,

Kiryll Prakapenka,