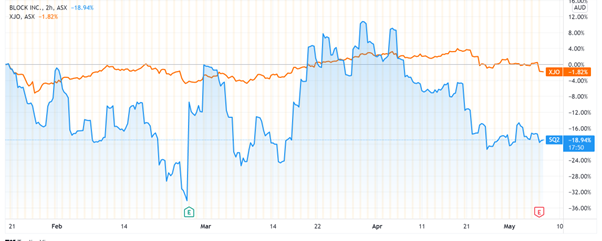

Block [ASX:SQ2], formerly-known as Square, released its March quarter to the ASX on Friday, reporting an earnings miss on a red day for stocks worldwide.

SQ2 shares, which now also trade on the ASX following Block’s seminal acquisition of BNPL Afterpay last year, were trading 2% lower in afternoon trade on the Aussie bourse.

Year to date, SQ2 shares are down 20%:

Source: Tradingview.com

SQ2 quarterly results

Block’s results were somewhat mixed.

RBC Capital Markets analyst Daniel Perlin, for instance, commented that the fintech’s quarterly net revenue, gross profit, and EBITDA all came in ahead of expectations.

But sales across the system were lower than expected.

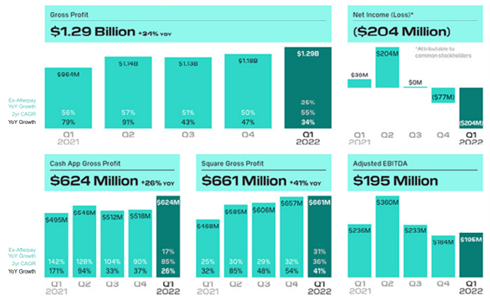

Block reported March quarter gross profits of US$1.29 billion, an increase of 34% year-on-year.

The company’s Cash App registered a 26% year-on-year increase, totalling US$624 million for the quarter.

The Cash App recorded the highest quarterly inflows ever during the March quarter.

Subscription and services-based revenue came to US$960 million, up 72% year-on-year, with subscription and services-based gross profits up 63%, totalling US$764 million.

However, the rise in gross profits was not enough to offset other expenses.

Block ended the March quarter with a net loss of US$204.2 million, down from a net profit of US$39 million in the prior corresponding period.

Operating expenses totalled US$1.52 billion for Q1 2022, up 70% year-on-year.

Source: SQ2

SQ2 share price: tech stocks down as markets worry about inflation

Friday was a big red day for stock markets, as jittery investors continue to mull over recent moves from central banks.

Tech stocks were hit hardest.

Overnight, the US tech-heavy Nasdaq Index fell a whole 5%.

And the Dow Jones Industrial Average registered its largest decline this year 24 hours after its largest gain since 2020.

With bond yields spiking in recent weeks due to hawkish central bank policies, growth stocks with high cash burn are coming under pressure.

Including Block.

Its acquisition of Afterpay — a BNPL stock yet to turn a profit and which requires a lot of capital to fund its receivables — doesn’t help manage that cash burn.

As Andrew Bauch of SMBC Nikko Securities America noted:

‘SQ appears to be in the crosshairs of cyclical sensitivity within the seller merchant base, and outsized exposure to ‘low-end consumers’ which many are anticipating will be the first cohort to rein in discretionary spend amid a downturn.’

We’re entering a highly volatile time for stocks right now.

It seems we’ve entered a time where investors lack the conviction to hold ‘one position for any length of time’, said Christopher Sullivan, chief investment officer at United Nations Credit Union.

But such times can offer opportunities.

There’s a bit of a cycle when it comes to buying and selling stocks on the ASX — sometimes, when it looks like stocks are out of favour — it could be a good time to hunt for bargains.

But you have to know what you’re looking for, and follow a certain strategy…

Our expert Callum Newman has used the ‘Sam Zell strategy’ and found three left-for-dead stocks that could come alive and run-up in price.

Click here to read about the three ‘grave-dancer’ stocks.

Regards,

Kiryll Prakapenka,

For Money Morning