Investment manager Pendal Group [ASX:PDL] was up 7% on Tuesday afternoon, bucking the downward trend across global share markets.

While Pendal went against the grain on Tuesday, it’s still down 25% over the past year.

Earlier this morning, the Australian share market opened 2.1% lower, hitting a three-month low. The resources and technology sector were heaviest hit.

Source: Tradingview.com

Pendal reports profit lift

Pendal’s first-half profit rose 7.5%, giving the firm room to raise its dividend by 24%. Pendal partly attributed the profit and dividend increase to its US-based subsidiary Thompson, Siegel & Walmsley (TSW).

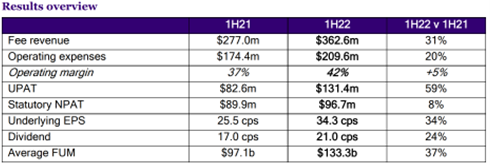

Net profit rose to $96.7 million, with underlying profit increasing 59% to $131.4 million and fee revenue increasing 30% to $362.6 million.

Operating margins went up 5% since the previous half, which Pendal attributes to ‘prudent cost management’, despite a 20% increase in operating expenses totalling $209.6 million.

Realised performance fees came to $44.5 million for the period, uplifting margins by 8%.

Acquisition of TSW has gone well, as have strategic initiatives for global distribution, infrastructure, and talent; with PDL also gaining EU MiFID licence approval for a new office in Paris, strengthening US, UK, and Euro ties.

Source: Pendal

CEO Nick Good commented:

‘Pendal Group has delivered a solid first-half result in a tough environment for asset managers. We delivered healthy growth in revenue, underlying EPS, UPAT and the interim dividend. While continuing to invest in our business, we have taken a more disciplined approach during the period, in response to the current market environment and tempered investor confidence.

‘Pendal acquired TSW in 2021, materially enhancing and diversifying our US product range. We have seen TSW’s value strategies outperform in the past quarter, and despite cautious US investor sentiment, TSW’s international strategies have seen inflows.

‘Our targeted set of strategic initiatives are designed to enhance our existing global distribution footprint and extend product diversification in growth areas, such as impact and thematic investing. Furthermore, we continue to invest in our global infrastructure to leverage Pendal’s expanded scale, drive efficiencies and deliver a world-class operating platform for fund managers and clients.’

PDL share price outlook

Likely contributing to Pendal’s share price jump today, PDL’s earnings per share (EPS) beat consensus expectations by 22%.

Broker Jarden said Pendal’s EPS beat its estimates by 34%, with the broker noting:

‘Despite peers struggling to manage the current inflationary environment, cost control remains a focus for Pendal, with the company flagging 1-2 per cent financial year operating margin expansion on the prior corresponding period.

‘Broad fund performance pleasingly stepped up on medium-term time horizons, with 86 per cent of funds under management now outperforming benchmark on a three-year basis.’

Despite Pendal’s spike today, it’s been a rough day overall for the market.

But in this volatility resides opportunity.

As Pendal showed today, some businesses can still post strong results and be rewarded for it.

The trick is to find these businesses at a time when fear is high.

For instance, only four stocks on the ASX reached their 52-week high today, with more than 150 stocks reaching their 52-week lows.

But a sell-off of these proportions can be enticing for the expert bargain hunter.

What strategy could be useful at a time like this?

Our small caps expert Callum Newman thinks he’s found three ‘grave-dancer’ stocks for these volatile times.

To hear about the grave-dancing stocks, read on here.

Regards,

Kiryll Prakapenka,

For Money Morning