Australia’s largest bank — the Commonwealth Bank of Australia [ASX:CBA] — released its 3Q22 results, reporting margin pressures and heightened competition.

Despite revealing margin pressures, CBA shares were flat on Thursday, as the broader market fell 1.5% in late afternoon trade.

As central banks sweat over battling inflation, attention will turn to banks and how looming interest rate hikes will influence banks’ margins

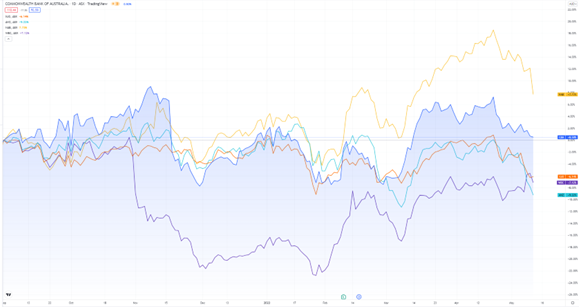

Source: Tradingview.com

CBA trading update: margin squeeze

Here are the key figures from CBA’s 3Q22 update (unaudited):

- Statutory NPAT of $2.3 billion

- Cash NPAT of $2.4 billion, down 2% on 3Q21

- Household deposits up 13.5% on 3Q21

- Home lending up 8.5% on 3Q21

- Business lending up 12.6%

Despite volume growth of 3%, CBA also reported ‘margin pressure from elevated swap rates, mix effects and competition.’

CBA did report that ‘improvements in economic conditions and sound portfolio credit quality’ resulted in a reduction in impairment expenses.

CommBank noted that it remains cautious in its management of potential risks.

CBA outlined higher interest rates, inflationary pressures, and supply chain disruptions as the primary risks.

Source: CBA

CBA share price outlook

While CBA shares were flat, it was a different story for challenger bank Judo Capital Holdings [ASX:JDO].

JDO shares were up 6% in late trade today after releasing an investor update yesterday.

The new bank — describing itself as a ‘cloud native’ — revealed it was on track to meet targets set in its prospectus.

Judo was also positive about the rising interest rate environment, calling the looming hikes a ‘tailwind’ for the firm as it aims for a net interest margin of 3%.

As for CBA, CEO Matt Comyn offered his thoughts on the latest quarter:

‘The March quarter underlined the disciplined execution of the Group’s strategy, focused on our core banking franchises, which delivered continued volume growth, sound portfolio credit quality and ongoing support for our customers and communities…

‘Continued growth in household deposits, home loans, business lending and business deposits was a feature of the quarter. The Group maintained strong balance sheet settings and paid $3 billion in half-year dividends to shareholders.

‘The previously announced on-market share buy-back of up to $2 billion will be conducted across the remainder of this calendar year, and last week regulatory approval was obtained from the China Banking and Insurance Regulatory Commission in respect of our previously announced partial sale of shares in the Bank of Hangzhou Co., Ltd.

‘Looking ahead, we are well positioned to support business investment to build Australia’s future economy.’

As markets slide, is it time to go ‘grave dancing’?

Picking stocks in the current climate seems overly risky.

‘Buying the dip’ could really mean catching a falling knife.

But abnormal volatility in today’s markets can cause abnormal mispricing opportunities for the savvy bargain hunter.

Or a ‘grave dancer’.

A what?

In 1976, famed American investor Sam Zell wrote an article when the US had seen a massive property boom and bust.

For him, the collapse was a chance to go shopping. And he called it ‘grave dancing’.

Well, nearly five decades later, our small-cap expert Callum Newman thinks it’s time to go grave dancing again.

Callum’s identified three grave-dancer stocks he thinks are mispriced by a fearful market right now.

To hear more about them, click here.

Regards,

Kiryll Prakapenka,

For Money Morning