Donations fintech Pushpay Holdings [ASX:PPH] released its annual results on Wednesday, with net profits hitting US$33.4 million in FY22.

PPH shares closed slightly lower on Wednesday, as the wider market continues to grapple with fears of a bear market brought on by rising interest rates.

Despite the wider sell-off in recent weeks, Pushpay shares have held firm in the last month, up 15%.

This is likely due to the fintech revealing late last month that it received expressions of interest by multiple undisclosed parties to acquire the firm

Source: Tradingview.com

Pushpay’s FY22 results

On Wednesday, Pushpay released its annual results.

Pushpay is a donor management platform, which offers the faith and not-for-profit sectors donor and finance tools.

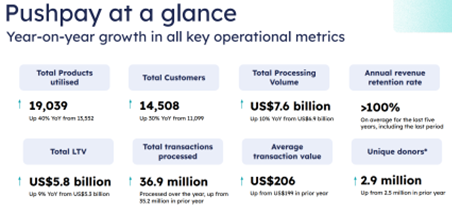

Here is a summary of Pushpay’s FY22 performance:

- Revenue up 12% to US$202.9 million

- Net profit up 7% to US$33.4 million

- Total customers rose 30% to 14,508

- Total processing volume rose 10% to US$7.6 billion

- Total transactions processed rose 5% to 36.9 million

- Gross margin steady at 68%

Underlying EBITDAF came to US$62.4 million, which the company said was in line with its guidance for the year.

However, earnings are expected to reach between US$56 million and US$61 million for 2023, an impact brought about by ‘investment in growth opportunities’.

Customer growth has risen 31%, from 11,099 to 14,508 existing customers. The company admits this was a ‘soft’ period, acknowledging that 2,858 new customers was ‘lower than internal expectations’.

Operating costs, on the other hand, increased 28% (US$83.4 million) which PPH explains is mostly due to acquisition expenses and an ‘increasing investment in people’.

Source: Pushpay

PHH share price outlook

Pushpay CEO Molly Matthews commented on the FY22 performance:

“Pushpay’s long-term growth strategy is focused on four areas – growing Customer numbers, increasing the number of Products utilised, expanding and enhancing Pushpay’s suite of products, and increasing share of wallet.

Significant progress has been made executing against strategic priorities in each of these areas, setting the foundation for escalating growth in future years.

A number of initiatives were implemented during the year to respond to market headwinds, including to refresh and strengthen Pushpay’s go-to-market strategy and investment in talent and capability.

A key highlight during the 2022 financial year was the acquisition of a leading video streaming provider, Resi Media in August 2021, which provides significant value and growth opportunities.

Pleasingly, we are now seeing benefits from these actions, with the full benefits to be seen from FY24 onwards following a further year of investment, particularly in people and capability, in FY23.”

With its modest growth in revenue and transaction volumes, Pushpay will likely seek new markets to accelerate growth.

The CEO highlighting the recent acquisition of video streaming provider Resi Media is telling, as the fintech looks to branch out.

Time will tell whether Pushpay’s new ventures succeed or whether it stretches itself thin, hurting its core product offering.

Fear is certainly gripping markets right now.

Inflation, interest rates, recession fears, risk-off selling…

But the current climate is ripe for opportunities, as indiscriminate selling leads to mispricing.

But how best to identify the opportunities?

Our expert, Callum Newman, recently released a report on ‘left-for-dead’ stocks that could rebound in a big way.

You can find out more about Callum’s three ‘grave-dancer’ stocks here.

Regards,

Kiryll Prakapenka,

For Money Morning