In today’s Money Weekend…markets attempt to rally…economy slowing rapidly as liquidity dries up…New York state business conditions…and more…

After weeks of relentless selling in bonds and equities, markets have pulled back from the brink and are attempting to rally.

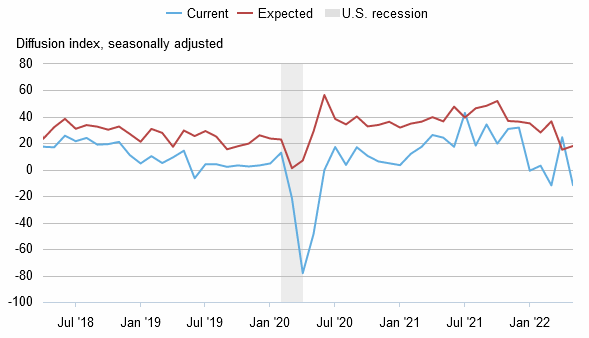

Soft macro data out of the US is showing that the economy is slowing rapidly as liquidity dries up. The New York Empire State Manufacturing Index surprised to the downside, falling into negative territory, which shows there is a contraction in manufacturing.

The General Business Conditions Index retreated 36 points to -11.6, its second negative reading in the past three months. The New Orders Index fell 34 points to -8.8, and the Shipments Index plunged 50 points to -15.4, marking a sharp reversal for the two measures, both of which increased last month.

New York state business conditions

|

|

|

Source: Newyorkfed.org |

Other data released during the week showed a similar pattern.

The market is seeing this as good news because it might shorten the time it takes for the Fed to bring inflation back under control. Bonds rallied, and stocks took heart with bargain hunters stepping in and lifting stocks from oversold levels.

This could be the beginning of a larger rally, but I think it will have a use-by date within the next month or so — or even earlier. I set out the conditions that I need satisfied to become more bullish in the ‘Closing Bell’ video below.

I also look at a few of the battery metal and energy markets that are catching a bid. I analyse the US 10-year bond yield, US dollar, Australian dollar, nickel, rare earths, lithium, uranium, and the S&P 500.

Click on the picture below to watch my latest instalment of the ‘Closing Bell’:

Until next week,

|

|

Murray Dawes,

Editor, Money Weekend