Bubs Australia [ASX:BUB] rose as high as 77% on Monday after signing an emergency supply deal to aid the US infant formula shortage.

Bubs Australia [ASX:BUB] isn’t wasting a crisis.

The company has clinched a deal to supply the US with tins of baby formula as the country continues to suffer from an infant formula shortage.

The share price surge has elevated BUB shares to a level not seen since November 2020.

The infant formula stock is now up 105% over the past 12 months:

Source: TradingView.com

Bubs to assist US baby formula crisis

Bubs announced today that the US FDA has allowed the immediate import of Bubs baby formula into the US in an effort to ease their serious baby formula shortage.

The US baby formula market has been squeezed since February due to supply chain issues and a massive recall hitting a major retailer.

More than 20% of powdered baby formula was out of stock in early May, with manufacturers rushing to boost production.

As The Wall Street Journal reported:

‘There are a few reasons for the shortage. Supply-chain issues caused by the Covid-19 pandemic have made baby formula harder to find for months.

‘The shortage worsened after Abbott Laboratories, a major formula manufacturer, voluntarily recalled some products and closed a plant in Sturgis, Mich., where Similac and its other brands were made.

‘Panic buying as news spread of the shortage may also be an issue.’

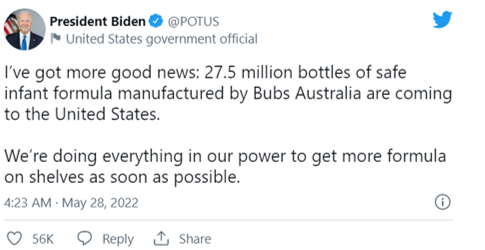

The shortage prompted authorities to act, with even US President Biden addressing the crisis.

Bubs ended up part of the emergency measures.

Source: Twitter

Bubs and the FDA make a deal

Now, Bubs’ products already meet the US infant nutrient requirements. The company already has a retail presence in the US since June 2021.

But the recent FDA deal will expedite the import of Bubs’ formula.

Bubs said it has made commitments to provide at least 1.25 million tins in the coming weeks and months (equivalent to at least 27.5 million bottles).

500,000 tins are ready for immediate shipment to the US. The productions of the remaining 750,000 tins has been planned and is scheduled for completion in the coming months.

BUB said its products are manufactured in an FDA-registered production facility, which is capable of tripling the current annual capacity of 10 million tins.

Bubs CEO Kristy Carr said:

‘As an Australian infant nutrition specialist, we welcome the opportunity to support American families in this time of need and provide an immediate source of sale, reliable and clean range of infant formula.

‘Australia and the United States have relied on each other in times of crisis for more than 100 years. This is no different and all credit goes to the US Government for fostering initiatives that allow us to respond and assist. Bubs is uniquely positioned with an existing nationwide sales and distribution footprint, enabling us to stock shelves with existing and prospective retail partners quickly.’

Executive Chairman Dennis Lin added:

‘Bubs had identified USA as a strategic key market two years ago, and our commitment to invest has thankfully coincided with American families’ time of need. This allows us to accelerate our strategic vision as well as provide support that goes to the heart of the Bubs DNA.’

BUB share price outlook

Some questions emerge.

One, what happens when US infant formula manufacturers resolve their supply chain and recall issues and normal production resumes?

How will that affect Bubs long term?

Two, will the emergency importation of Bubs formula see the company secure lifelong customers?

Will this emergency measure help Bubs permanently capture market share from local US rivals?

And lastly, what will the financial windfall be for Bubs? Will it have a material effect on its financial results?

The next few months will be telling.

With ongoing supply chain issues, rising interest rates, and recession concerns, it might seem like the wrong time to be looking at investing opportunities right now.

But as the BUB share price surge shows, opportunities still exist, even in today’s markets.

The trick is knowing where to look…and act before the herd.

How do you do that?

Callum Newman, our small-cap expert, has a strategy for cherry-picking ‘left-for-dead’ stocks likely to rebound strongly on market rerates.

Find out more about Callum’s ‘grave-dancer’ stocks here.

Regards,

Kiryll Prakapenka,

For Money Morning