Envirosuite Limited (ASX:EVS) has released business update regarding its EVS Water segment extending into new markets.

Despite the announcement, EVS shares were largely flat on Tuesday.

While the stock is up 40% over the past 12 months, EVS is down 25% year-to-date, not immune to the wider sell-off:

Source: Tradingview.com

EVS Water goes global

Envirosuite — the environmental technology small-cap — today announced that its EVS Water business arm ‘has gone global’ with new customers registered in Australia, Asia, Europe, and the US.

EVS Water is Envirosuite’s most recent product line, launched in 2021.

Envirosuite thinks the global market opportunity for EVS Water is around $2.8 billion per year.

EVS thinks the $2.8 billion figure is a fair representation of the serviceable addressable market ‘that can be meaningfully reached by Envirosuite’s software and solutions.’

Despite the large annual TAM figure, Envirosuite reported that EVS Water is nearing its ‘initial commercial objective of achieving $1 million in total sales.’

Clearly, the upside from here is large.

But the obvious question is whether EVS Water can scale up its sales to anywhere near that TAM estimate.

What value does EVS Water offer customers?

Envirosuite noted that EVS Water has a key product — the EVS Water Plant Optimiser software.

This software helps customers to ‘materially reduce the two highest costs in water treatment and delivery: electricity and chemicals.’

According to EVS, the operation also lessens the collective environmental footprint of its users.

EVS shared that customers have appreciated its ‘climate impact and reporting’ as electricity consumption and emissions dwindle.

On a financial note, customer pricing has offset production, while specially developed assets have protected against chemical strain, upgrade, and replacement costs.

EVS share price: where is the company heading?

Jason Cooper, CEO, said:

“EVS Water is the newest, highest margin, and fastest growing of our three product lines with the largest prospective market size. Our widespread customer wins demonstrate that it is quickly receiving market validation by industry leaders in each major region of the globe.

As we have shown with EVS Aviation, we know what it takes to be a global market leader. With the supportive capital raise completed in December 2021 we are well funded to achieve our growth objectives by leveraging Envirosuite’s existing global footprint of customers, people and partners to penetrate the enormous market for EVS Water. We’ve invested in a high calibre, industry experienced sales team, along with a specialist product and development team that includes several PhDs to expedite the commercialisation and scalability of EVS Water.

With the initial success to date and scalable opportunities ahead there is confidence that this new product stream could be a substantial future contributor to group revenues and earnings.”

In April Envirosuite released its third quarter update, in which the company reported sales orders climbing to $3.7 million.

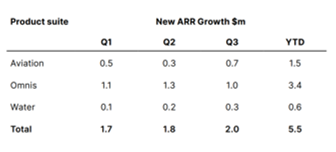

Annual Recurring Revenue year-to-date (31 March) was $5.5 million, an improvement of 23.6% year-on-year.

Source: Envirosuite

Now, Envirosuite isn’t the only small-cap involving itself with the sustainability and green revolution.

The battle against emissions and climate change is waged far and wide.

But our resident small-cap expert Ryan Clarkson-Ledward thinks he’s found one neglected Aussie small-cap that can achieve greatness by helping Europe stave off its energy crisis.

To get the scoop on the topic, click here.

Regards,

Kiryll Prakapenka,

For Money Morning