PeopleIn Limited [ASX:PPE] shares rose as high as 10% on Friday after acquiring Food Industry People, a ‘leading PALM workforce solutions business’.

Despite the spike on Friday, PeopleIn, the workforce and recruitment business, is down 25% in the last 12 months:

Source: TradingView

PeopleIn makes an acquisition

PeopleIn is set to acquire Food Industry People (FIP), a workforce solutions business and ‘one of the largest providers of staff to the food sector in Australia’.

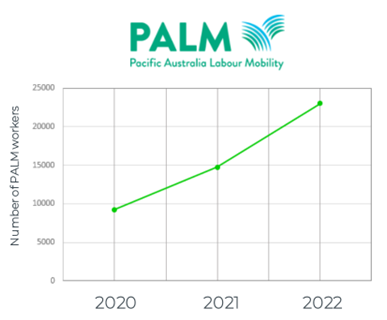

FIP operates under the Pacific Australia Labour Mobility Scheme (PALM), addressing labour shortages in Australia by attracting workers from the Pacific Islands.

As PPE explained:

‘FIP was established in 2006 and has grown to be a national leader in workforce solutions under the PALM Scheme, with ~4,500 people in work.

‘FIP workers are employed on a fixed term basis for the duration of their visas (typically 3–4 years) and are assigned directly to a host employer for the duration of their stay.

‘As part of its responsibilities as an employer, FIP provides a dedicated pastoral care program which includes providing workers with access to accommodation, transport, healthcare and connecting workers with local community services, churches and sporting clubs.’

Source: PPE

PeopleIn said acquisition is expected to bring in an annualised pro forma EBITDA of $9.5 million and earnings per share accretion of about 15% in FY23.

What is the cost of PPE’s acquisition?

The upfront consideration is $45 million ($35 million in cash and $10 million in PPE shares).

This represents a pro forma EBITDA multiple of 4.7 for FY23.

PeopleIn may be on the hook for a further $25 million as a deferred cash consideration based on the business achieving agreed EBITDA growth in FY23 and FY24.

The transaction is expected to settle in mid-June.

Mr Ross Thompson, PeopleIn CEO, commented:

‘PeopleIN has acquired an at scale international recruitment engine room to be leveraged by our defensive growth sectors, including food services, healthcare and aged care.

‘Our investment via the PALM Scheme will help solve the significant employee shortages faced by our clients, and the broader market, by bringing in workforces at scale.’

PPE share pricing and the Australian labour force

PeopleIn management commented that the acquisition is expected to help Australia deal with its labour shortages:

‘The food supply chain is essential and despite the challenges experienced during the COVID-19 pandemic, global food supply chains demonstrated remarkable resilience in the face of disruptions.

‘Furthermore, the outlook for the Australian food sector is strong due to new and ongoing free trade agreements driving growth in exports. In addition, economic recovery from the COVID-19 pandemic is forecast to boost demand for Australian food from international markets over the next five years.

‘The acquisition of FIP increases PeopleIN’s participation in the food sector and cements our position as the largest ASX-listed recruitment and staffing company in Australia.’

Now, if you’re looking for opportunities in today’s jittery market, I suggest checking out the thoughts of our small-cap expert Callum Newman.

Callum has a strategy for picking out those ‘left-for-dead’ stocks that are most likely to bounce back.

You can find out how he does it, ‘grave-dancer’ style, here.

Regards,

Kiryll Prakapenka,

For Money Morning