Anson Resources [ASX:ASN] shares jumped 11% on Monday after the company released a DFS update regarding its Paradox Lithium Project.

The lithium miner has endured a volatile trading year, accentuated with peaks and troughs over the past 12 months.

Despite the turbulence, ASN is up 135% in that time:

Source: marketindex.com

Anson flags boost in lithium production capacity

On Monday, Anson Resources confirmed its plans for a ‘major increase’ in planned production capacity at its Paradox Lithium Project in Utah.

Paradox’s detailed feasibility study (DFS) aims to target a Stage One production capacity of 10,000 tonnes per annum of battery-grade lithium carbonate.

ASN noted the increased production represents a 275% increase from the 2,674tpa production capacity reported in September 2021.

Anson said the decision to increase lithium production was driven by three factors:

‘ • Anticipated significant JORC resource increase at the Project;

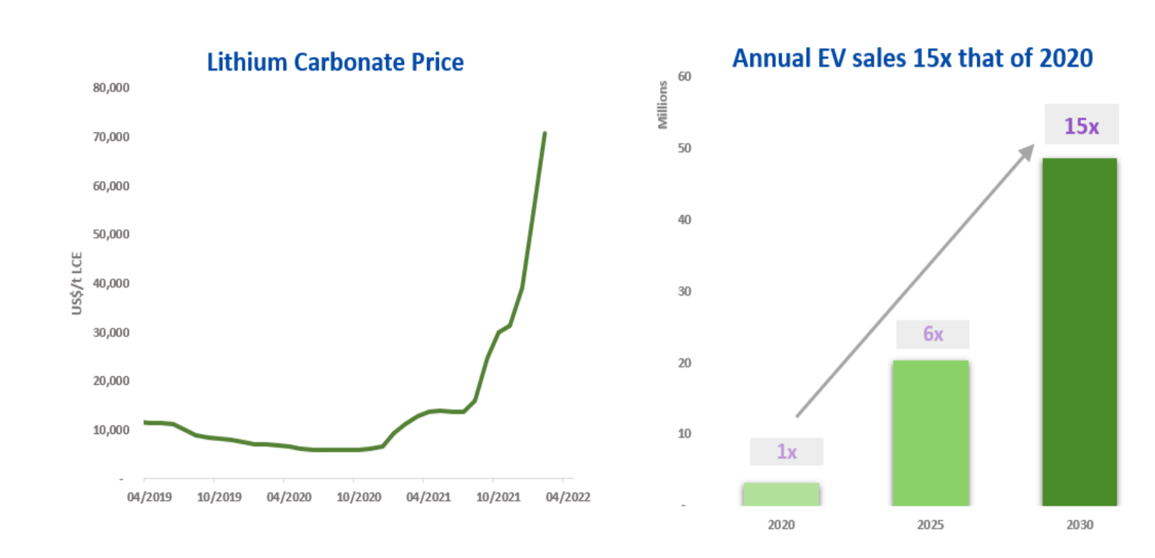

‘ • Growing lithium demand and higher lithium prices; and

‘ • Enhanced lithium recoveries and superior performance of Anson’s 99.95% purity lithium carbonate.’

Anson will also increase its bromine production in conjunction with US support and rising global demand for zinc-bromine batteries.

ASN share price and lithium forecast

For lithium, Anson reports the current sell price for battery-grade lithium carbonate is around US$79,550 a tonne, a 1,000% increase in the last 24 months:

Source: Anson

Bruce Richardson, Anson’s Executive Chairman further commented:

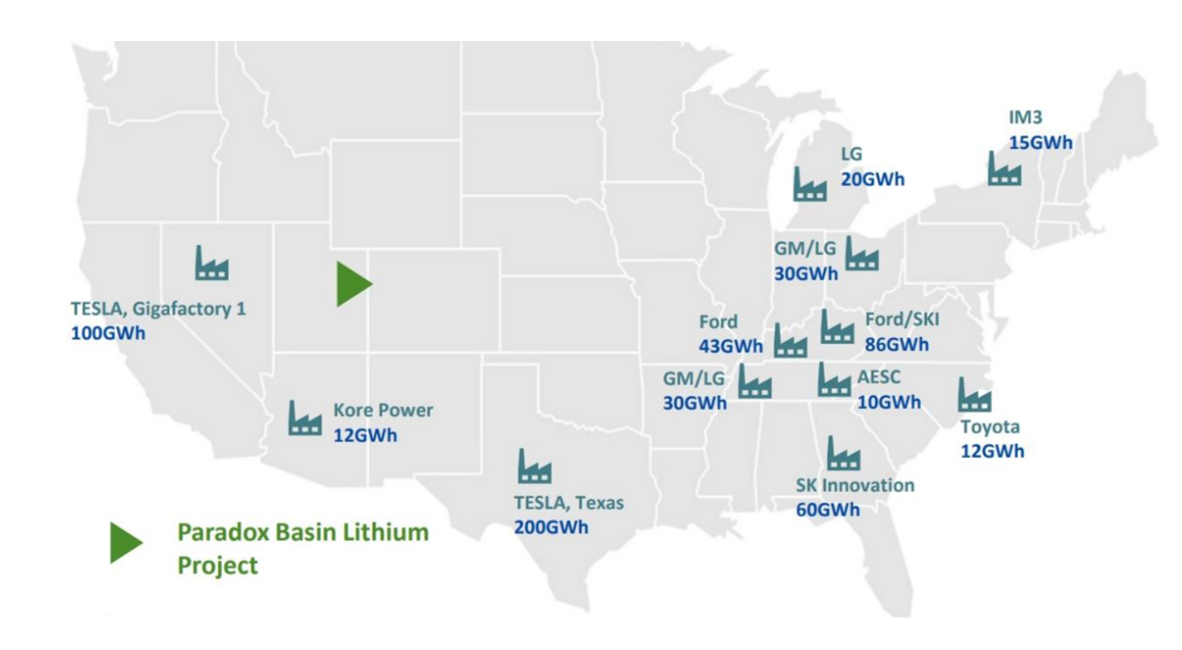

‘The decision to increase our proposed Stage 1 Lithium Carbonate production capacity to 10,000tpa will enable Anson’s shareholders to take advantage of the burgeoning lithium market and realise more value from of the immense potential of the Paradox Lithium Project. The U.S. location of the Project means Anson is strategically well-placed to benefit from increasing commitments by U.S. car manufacturers towards Electric Vehicles and announced investments in developing U.S. based battery manufacturing facilities.’

Anson also flagged the allocation of US$20 billion in low-interest loans by the US government to ‘support the transition from fossil fuels to an alternative energy economy, including the development of a domestic lithium supply chain.’

Anson thinks the location of its Paradox project in Utah is advantageous, given the growing battery tech supply chain in America:

Source: Anson

Now, while lithium is grabbing a lot of the attention as we switch from ICE vehicles to electric vehicles, it isn’t the only metal needed for the green energy future.

In fact, there’s a smarter way to play the EV theme, given how much capital the lithium sector has attracted, crimping gains.

In one of our latest research notes, we’ve called this battery tech metal lithium’s ‘little brother’.

If you would like to find out more about it, click here to read ‘The NEXT Lithium‘ report.

Regards,

Kiryll Prakapenka,

For Money Morning