What’s the most valuable piece of property on the Moon?

Not a question on most investors’ minds right now, I’ll bet!

But as I found out last Thursday, it could be a very important thing for you to start taking note of.

You see, already some very secretive investors are making moves to lock up this prime ‘real estate’.

I’ll let you in on their preferred locations shortly.

But first…

Let me take a step back for a second and explain how this topic even came about.

And, in turn, why the future is a lot brighter than many think, especially for Australian investors…

Working out what happens next

Last Thursday, the editors of Fat Tail Investment Research came together in Melbourne for a roundtable discussion.

It was the first time we’ve been able to do a face-to-face meeting for more than two years, and it was good to catch up with colleagues.

The idea behind the powwow was to talk about our best ideas and work out how we can help you invest in them.

But the first part of the meeting was a discussion about the current economic situation.

As usual, there was a range of opinions and a good deal of heated debate!

Our Editorial Director Greg Canavan floated the idea of two more rate rises out of the Fed and then a pause.

He thinks we’ve already seen peak inflation, and by the last quarter of the year, central banks might be more concerned with growth again.

That could mean the end of any quantitative tightening or a slowdown in the pace of interest rate rises.

This would be good news for stocks.

The contrary view was that this is just your typical relief rally — a rally that will fizzle out as some use the rebound to exit their positions.

As ever, time will tell.

We all agreed on one thing, though.

And that was how ridiculous it was that we lived in a world where central banks so strongly determined the fate of markets.

It’s never been so bad…

Never forget

On that note, Treasury Secretary Janet Yellen came out last week admitting her previous position on inflation was a ‘mistake’.

She told CNN’s Wolf Blitzer:

‘I think I was wrong then about the path that inflation would take. There have been unanticipated and large shocks that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly that I…at the time, didn’t fully understand.’

Surely, she is resigning then?

Of course not…

That’s the problem with centrally managed monetary systems. We bear the costs of their ‘bad’ decisions while they continue on their merry way.

As Nassim Taleb would say, they’ve no ‘skin in the game’.

And even if you can credit this as an honest mistake, don’t forget we had the unedifying scene of Fed officials personally trading around their own decisions last year.

Check out this illuminating chart:

|

|

|

Source: TradingView |

What a coincidence that Fed officials are now happy to enact policies that negatively affect stock markets once they’re out of it!

Anyway, that’s not what I intended to write about today, but it’s hard to ignore the complete mismanagement and outright dodginess of these ‘hallowed’ institutions.

And it’s often left to businesses like ours to hold them accountable as the mainstream continues to subserviently doff the hat to their economic masters.

But with that off my chest, I actually walked away from last week’s meeting feeling very positive about the future.

Let me explain why…

The future is bright

At the roundtable, every editor presented their single best idea.

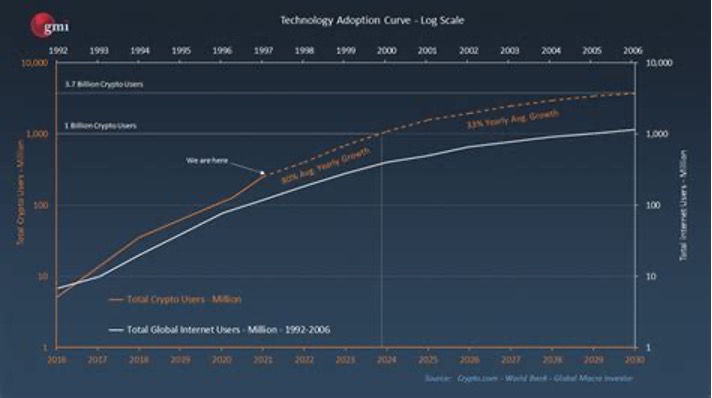

I led off the discussion by presenting my thoughts on why we could be about to enter the golden age of cryptocurrencies.

Not everyone agrees with me on this, but I think one chart resonated with my colleagues.

It was this one that shows the pace of adoption of cryptocurrencies versus the internet:

|

|

|

Source: CoinTelegraph |

As you can see, despite the ups and downs and the shrill cries from naysayers and critics, the adoption of crypto is growing very similarly to how the internet did.

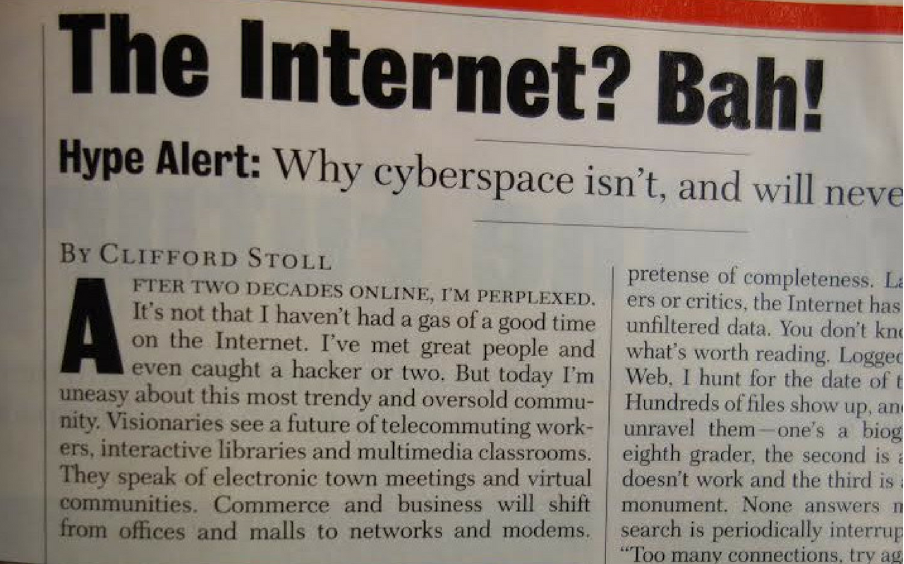

It’s hard to imagine now, but back then, the internet had just as many loudmouth doubters.

Articles like this one written in 1995 were commonplace:

|

|

|

Source: The New Statesman |

But while opinionated journalists and even Nobel Prize-winning economists like Paul Krugman (he said the influence of the internet would be no bigger than the fax machine!) wrote stuff like this, savvy tech investors like Marc Andreessen made a mint.

He made US$2 billion from investing in dotcom stocks and was famous for his thesis that software would eat the world.

His next big bet?

Cryptocurrencies.

Last week, for the first time, Andreessen compared the two, saying:

‘This is the only time I’ve ever said this is like the internet. If you go back through all my historical statements, one could imagine that with my experience I could have said this like 48 times. I’ve never made the comparison before.

‘I’ve never said it about any other kind of technology. I never said it about anything else between the original internet and then the emergence of crypto, because I just wanted people to know like I don’t take the comparison lightly.’

Like I’ve said a million times, don’t let the negativity in the mainstream distract you from the immensity of the opportunity here.

After me, a range of editors presented their own ideas.

We had a lot of talk on the future of energy and how Australia was ideally placed to benefit from this.

Our in-house energy expert Selva Freigedo told us how Australian miners were actually innovators in renewable energy technology through sheer necessity.

And she imagined a possible future where mining companies were also cleantech plays.

There’s the real possibility that Australia can become a renewable energy superpower.

In another presentation, Greg Canavan showed us how this downturn was presenting excellent opportunities to pick up quality stocks on the cheap.

He showed a number of examples of companies making good profits and high returns on equity that he was directing his subscribers to.

This approach is pretty much how Warren Buffett made his fortune.

And it was a timely reminder that you don’t always need to make risky bets to make good money. Simply buying good stocks in times of gloom is often good enough.

My co-editor at Exponential Stock Investor, Ryan Clarkson-Ledward, told us about an emerging US$1 trillion market in a little-known subset of the biotech industry.

Our trading expert Murray Dawes showed us how you could make 30% a year — even in this market — using his trading method (using actual track record results).

And there were more presentations with similarly exciting and optimistic opportunities right now for investors.

But the thing that struck me about the meeting was how upbeat we all were about the future.

We all specialise in different areas, and we can see just how much is going on behind the scenes in each space, despite the volatile economic backdrop.

Anyway, that was the biggest takeaway for me.

To ignore the ups and downs and keep concentrating on good, solid investment opportunities.

Do that right, and time will do the rest.

The hottest property on the Moon

In the last presentation of the day, our land cycles expert Catherine Cashmore probably provided the most ‘out there’ idea of the day.

Mining the Moon!

She told us she’s had meetings with some very serious people who have raised money to do this.

I won’t go into that topic today as I’ve run out of time, but I’ll tell you the hottest property on the Moon.

It’s the south pole.

Why?

Well, one half of the Moon is always in darkness (making it very cold), while the other half is always in the sun (making it very hot).

The south pole is the only shady part of the Moon and has some very large craters, making it ideal for landing spacecraft.

If Catherine’s right, the importance of this frivolous fact will become very apparent over the next few years…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.