Australian lithium producer Pilbara Minerals [ASX:PLS] secured a pre-auction bid of over US$7,000/dry metric tonne.

Pilbara said the price reflects ‘continued strong demand conditions.’

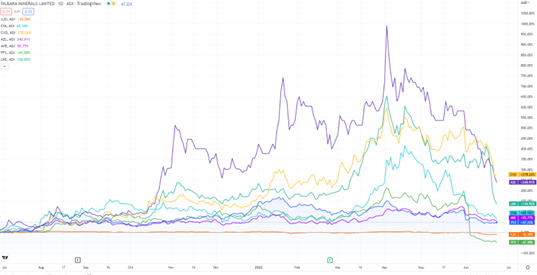

While the bid was positive news, Pilbara was not spared a lithium sell-off on Thursday.

Despite rising in morning trade, the PLS stock fell into the red by the afternoon, along with many of its lithium peers.

Hardest hit on Thursday was Lake Resources, who continues to shed market cap value following a sudden — and as yet unexplained — managing director exit.

LKE shares were down as much as 17%.

Newly listed spin-off Leo Lithium [ASX:LLL] was down 20% in early afternoon trade.

Sayona Mining [ASX:SYA] was down 11%.

Ioneer [ASX:INR] was down 10%.

Liontown Resources (ASX:LTR] and Novonix [ASX:NVX] were both down 8%.

Source: Tradingview.com

Pilbara’s Pre-BMX Auction Result

This morning Pilbara Minerals shared that it managed to secure a new price for its spodumene concentrate cargo after accepting a pre-auction bid before its sixth scheduled digital auction at the Battery Material Exchange (BMX).

Pilbara accepted an offer of US$6,350 dry metric tonnes (dmt) for 5,000 dmt on a 5.5% lithia basis.

Pilbara said the US$6,350 total sale price equates to around US$7,017 dmt when adjusting for lithia content and freight costs.

PLS plans to ship the spodumene in late July.

In a thinly veiled counter to Goldman Sachs’ recent bearish report on the outlook for lithium, Pilbara’s CEO, Dale Henderson said:

‘This is an exceptional outcome which provides further evidence of the unprecedented demand for battery raw materials being experienced across the global lithium-ion supply chain at this time.

‘Contrary to recent suggestions that the market has peaked, the evidence we are seeing at the coalface with our customers, including this pricing outcome, suggests that demand remains incredibly strong, with a continued healthy outlook for the foreseeable future.’

PLS share price outlook

Pilbara was happy with the pre-auction offer.

PLS managing director Dale Henderson thought the pre-auction bid showed demand remains ‘incredibly strong’.

But a question remains.

Why not go ahead with the auction? Why not see if the pre-auction offer could be bid up?

Did Pilbara believe the auction would not guarantee a higher price? If so, why?

For instance, just last month an auction for a controlling equity stake in a Chinese lithium mine saw 3,448 bids.

The winning bid was nearly 600 times higher than the starting price.

While that auction highlights the scramble for lithium supply, not all are convinced lithium prices can remain elevated.

By 2023 Goldman Sachs believes lithium prices will slump.

Credit Suisse also says there’ll be a lithium glut by 2025.

That may throw off some investors pondering the lithium sector.

But lithium is not the only material necessary for the EV transition.

In fact, given the acute interest in lithium stocks, there may be a smarter way to play the EV theme than loading up on lithium stocks.

The flood of capital into the lithium sector is making our team at Money Morning think there’s a better way to play the EV boom.

It involves what you can call lithium’s little brother.

Regards,

Kiryll Prakapenka,

Money Morning