Liontown Resources [ASX:LTR] shares were flat this morning, after announcements regarding a third Ford offtake and final investment decision (FID) for LTR’s Kathleen Valley Project.

LTR shares rose as high as 17% in early trade before retracing. In late afternoon trade, LTR shares were up 4.5%.

Liontown managed to buck the trend on Wednesday, as most lithium stocks fell.

At the time of writing, Sayona Mining [ASX:SYA] was down 11%. Ioneer [ASX:INR] was down 9%. Leo Lithium [ASX:LLL] was down 9%. Li-S Energy [ASX:LIS] was down 10%, and Arizona Lithium [ASX:AZL] was down 8.5%.

Despite the spike today, Liontown is down 30% year to date as the lithium sector continues to cool.

Source: Tradingview.com

Liontown makes a binding deal with Ford

Liontown and Ford have executed a definitive binding offtake agreement for the supply of up to 150,000 dry metric tonnes (DMT) per annum.

The initial deal has a five-year term from the commencement of commercial production, which LTR expects to be in 2024.

The deal is the third and final offtake Liontown requires to develop its Kathleen Valley lithium project.

More on that later.

The binding offtake with Ford also includes a funding facility agreement with respect to a $300 million debt facility which will be used to fund the Kathleen project.

A Ford subsidiary will provide the $300 million debt facility to LTR.

Together with binding offtake agreements with Tesla and LG Energy Solution, Liontown’s total offtake commitments now add up to 450,000dmt per annum of spodumene concentrate.

That’s about 90% of Kathleen Valley’s production capacity.

The remaining 10% of LTR’s spodumene will be used in ‘future spot volume sales and smaller offtakes’.

Kathleen Valley development gets the all clear

Given that the binding deal with Ford marks the third and final offtake required to develop the Kathleen Valley project, Liontown today also announced the final investment decision.

Liontown’s board has now formally approved the development of the Western Australia project, with the FID clearing the way for construction to commence.

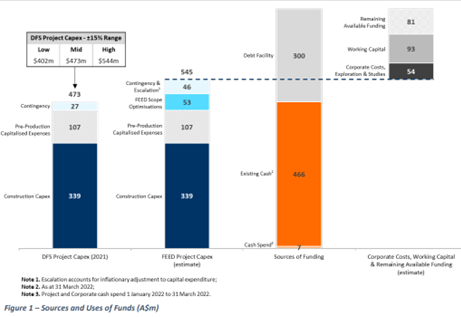

The $300 million debt facility, combined with last year’s $463 million capital raise, means that Liontown ‘has now secured commitments for the required funds to support the full development of the Project through to first production’.

Production will be expected in the Q2 2024 with early-grade control drilling in early 2023:

Source: LTR

LTR share price outlook

Liontown’s CEO Tony Ottaviano commented on the news:

‘The signing of our third and final foundational offtake agreement is a momentous milestone for Liontown and the Kathleen Valley project, with approximately 90% of Kathleen Valley’s start-up capacity now under secured long-term binding offtake agreements.

‘Our disciplined approach to our offtake strategy has enabled us to build a customer base of Tier-1, globally significant customers in the EV battery supply chain, validating Kathleen Valley’s status as a globally relevant lithium asset.’

Ford’s binding offtake with Liontown highlights the intensifying resources arms-race between automakers and battery manufacturers.

With giant automakers like Ford making their EV intentions very clear, securing supply of critical battery materials is becoming more and more important.

Liontown has done well to leverage that into binding offtakes — plus a hefty debt facility to boot.

Now comes the time to execute.

The next years will not be easy, as LTR is set to ramp up spending to construct its lithium project in Western Australia.

Already Liontown has had to refine its capital cost estimates.

As part of its Kathleen Valley FID announcement, LTR revealed that its capital cost estimate has increased from $473 million to $545 million.

As Liontown’s own managing director and CEO Tony Ottaviano noted:

‘Notwithstanding the significance of today’s announcement, Liontown’s central task lies ahead — safely building and commissioning our world-class Kathleen Valley Project.

‘This process begins by immediately securing high-calibre contractors and business partners to ensure we can deliver the Project safely and efficiently. We remain on track to deliver first spodumene concentrate by Q2 2024.’

Now, Liontown is one of several Aussie lithium stocks that have been boosted by their association with EV pioneer Tesla.

LTR shares leapt as high as 15% on the day of its Tesla offtake announcement.

Clearly, if you are one of Tesla’s ‘chosen ones’, the market takes notice.

What are some overlooked battery tech stocks on the ASX that can be Tesla’s next chosen ones?

Our small-caps expert Callum Newman has just recently released a new report, identifying three under-the-radar Aussia small-caps that can ‘Elon’s Chosen Ones’.

Regards,

Kiryll Prakapenka,

For Money Morning