EML Payments [ASX:EML] sank 20% on Monday after the Central Bank of Ireland found shortcomings with the remediation program of EML’s Irish subsidiary — PFS Card Services (PCSIL).

EML’s tough year continues.

After the recent — and sudden — departure of its CEO, EML has been hit with further regulatory issues surrounding PCSIL.

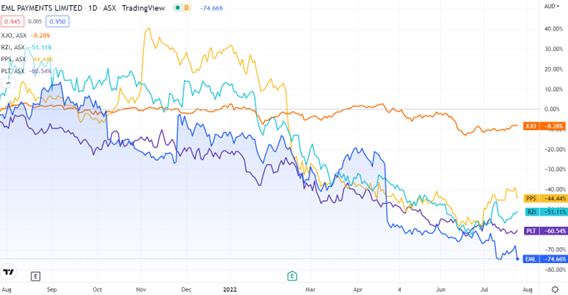

The steep fall today means the EML stock is now down 75% in the past 12 months, and down 35% in the past month alone.

www.tradingview.com

EML’s Irish subsidiary remediation delay

EML’s Irish subsiary, PCSIL, has been going through a remediation program at the direction of Ireland’s central bank since July 2021.

But while a year has gone by, EML says ‘there is more work to do’.

Ireland’s central bank has ‘identified shortcomings in components of the remediation programme’.

Primarily, the bank singled out PCSIL’s ‘approach taken to the risk assessment of its distributors, corporates and customers’.

EML said that in response, PCSIL will adopt a revised approach to its remediation, which may result in ‘additional controls being embedded into the internal control framework’.

EML has expressed that it will revise its approach to the issues identified by adding additional controls to its platform and framework.

EML further elaborated:

‘EML is wholly committed to full compliance with its regulatory obligations. We are confident that a best-in-class internal control environment provides enhanced customer and stakeholder value and positions EML well for scalable and sustainable growth in Europe and beyond. EML looks forward to further engagement with the investor community on release of our FY22 results on 22 August 2022. Details of EML’s scheduled investor call were announced on the ASX platform on 20 July 2022.EML reiterated its ‘full compliance’ with the CBI’s specified obligations, and highlighted its focus remains on its value and growth in Europe.’

Finding opportunities in today’s market

It can be a challenge to find opportunities in current market conditions.

But opportunities are out there.

Our small-cap expert Callum Newman has a knack for finding them.

His latest report names three battery stocks that he believes have the potential to be the next ‘chosen ones’ for leading battery mineral supply chains.

You can find out more by reading Callum’s report here: ‘Elon’s Chosen Ones’.

Regards,

Kiryll Prakapenka