Lithium developer Vulcan Energy Resources [ASX:VUL] has provided a regulatory update for its lithium project in Germany.

VUL reported that eight local councils have approved its upcoming 3D seismic program of works in the Rhineland region.

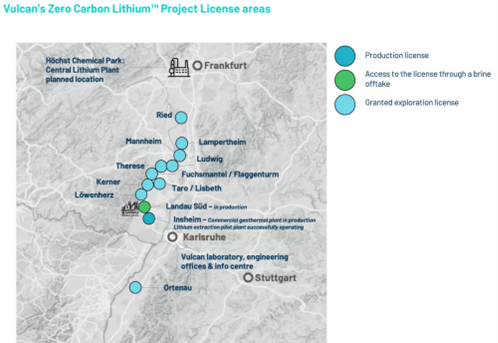

VUL also notified the market about the grant of a new exploration license.

The lithium developer’s exploration license area has now increased by 277km2, to 1,44km2.

VUL shares rose as much as 4.5% on Tuesday morning.

Despite today’s spike, the lithium stock is still down 30% YTD.

Vulcan’s license grant

Vulcan today revealed it can now commence a 3D seismic survey, thanks to the compliance of eight local councils across the German region of Rhineland-Palatinate.

The new licence increases the company’s exploration area in the Upper Rhine Valley Brine Field (URVBF) by 277km2, bringing the area total to 1,440km2.

Vulcan has now begun planning its 3D seismic survey, with material works to commence in September.

Vulcan already has some 3D seismic data for the new area, thanks to an agreement with Rhein Petroleum GmbH last November — yet the company expects more to come as Vulcan engages in discussions.

Vulcan’s Managing Director, Dr Francis Wedin, commented:

‘So far, all local votes for Vulcan’s work plan applications in our Phase 1 area have been positive, which is a strong endorsement for our Project, as well as for the reputation and professionalism for the Vulcan team; many of whom have worked in the geothermal industry and the local area for many years.

‘Our new exploration license, Ried, increases our license exploration area by 24%, for what is already the largest JORC compliant lithium resource in Europe. A strength of the Upper Rhine Valley region is the extensive exploration and development historically conducted by oil and gas companies, and Vulcan continues to leverage the work performed by the hydrocarbons industry to accelerate the Zero Carbon Lithium Project by reducing the amount of time required to gather data.

‘The grant of the Ried exploration license allows us to realise this data acquisition strategy, first executed last year. We are now well positioned to progress work in this area more efficiently and cost effectively, at a time of unprecedented demand for lithium for electric vehicles, and for renewable energy in Europe.’

Source: VUL

The great EV battery tech race heats up

Vulcan seeks to be a big player in Europe’s lithium supply chain, anticipating the region to be at the forefront of electric vehicle (EV) adoption.

But the speed in which countries and governments are advocating for EVs is leading to a supply crunch.

As automakers worldwide pivot to EVs, they must secure more battery tech materials.

And that’s putting a fire under the prices for key materials like; lithium, graphite, copper, nickel and cobalt.

Our energy expert Selva Freigedo thinks the industry is set for a supply crunch, leaving the prices for battery tech materials elevated in the medium-term.

Selva has recently profiled the three key metals at the forefront of the EV revolution.

To read her report, ‘Three Ways to Play the Great EV Battery Race’, click here.

Regards,

Kiryll Prakapenka