Long-suffering ASX BNPL stocks have been surging in recent weeks, with Openpay Group [ASX:OPY] no exception as the fintech released its Q4 FY22 results.

Openpay reported ‘another record-breaking quarter with market-leading margins’.

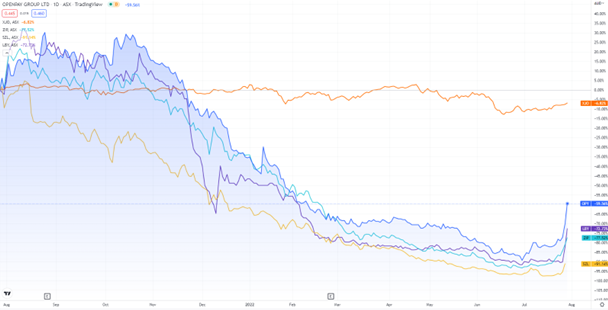

OPY shares were up 35% in late Thursday trade and up 200% in just under a month:

www.TradingView.com

ASX BNPL stocks surge

What’s happening with the local BNPL sector?

BNPL stocks, all down more than 50% in the past year, have spiked in recent weeks.

Consider this.

OPY is up 120% this week.

Zip is up 120% this week.

And Sezzle is up a whopping 300% this week!

Openpay delivers record-breaking quarter

As BNPLs continue to spike, Openpay released its quarterly update, claiming ‘another record-breaking quarter’.

These results were driven, according to OPY, by ‘market-leading margins and low bad debts’.

Here are the highlights:

- ‘Active Plans of 1.8m, an increase of 50% compared to pcp (Q4 FY21)

- ‘Active Customers of 321k, an increase of 21% compared to pcp

- ‘Over 4,100 Active Merchants, compared to 3,700 in Q4 FY21

- ‘A quarterly TTV record of $97.6m, an increase of 54% compared to pcp

- ‘Total quarterly Revenue (including OpyPro) reached a record $8.5m, up 80% compared to pcp’

OPY also reported improvements in its margins:

- ‘Revenue Margin has improved from 7.3% in Q4 FY21 to 8.1% in Q4 FY22

- ‘Net Transaction Margin (NTM) has improved from 2.0% in Q4 FY21 to 3.4% in Q4 FY22

- ‘Net Transaction Loss (NTL) has improved from -1.5% in Q4 FY21 to -1.1% in Q4 FY22’

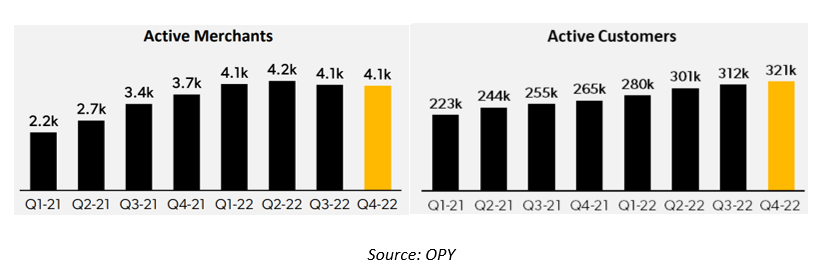

Now, despite reporting solid year-over-year growth in key metrics, it was a somewhat different story when considering quarter-on-quarter growth.

For instance, OPY’s active merchants’ growth has stagnated, not moving since Q1 FY22:

Source: OPY

OPY pauses US operations

Openpay also said its US operations will be put on hold due to ‘current macroeconomic and market conditions’.

The company wishes to focus on capital and resources, ‘delivering core profitability in Australia by June 2023’.

It will, however, investigate opportunities in the US and UK ‘in a capital-light manner’.

Australia is now OPY’s core operating jurisdiction.

Openpay share price outlook

Openpay’s CEO, Dion Appel, commented on the quarter:

‘This last quarter saw Openpay take some further tough but important decisions which has allowed the Company to focus on its core operating platform in Australia (across both B2C but also B2B via OpyPro). As these quarterly results highlight, the ability to focus our capital, people and strategy on Australia (which has always been our home market) versus multiple jurisdictions is delivering the outcomes we are seeing in the continued growth in TTV and revenue, the strength of our gross and net margins (arguably the strongest in our peer set), whilst at the same time continuing to deliver and improve our extremely low arrears and bad debts. This focus has allowed us to target hitting cash flow profitability by June 2023 and we remain committed to that target.

‘We will continue to optimise the business on an ongoing basis as well as look for opportunities to accelerate to profitability should they present themselves. Sometimes being the smaller guy in the room allows you to adapt and pivot quicker to the market environment we operate in than our larger peers. We think we have been decisive in our decision making and quick to then execute on those decisions and this remains one of our key advantages.’

BNPLs may be the flavour of the week, but there’s a sector that’s likely the flavour of the decade: electric vehicles.

Lithium dominated headlines in 2021, but we can’t forget the equally necessary battery materials copper, nickel, cobalt, and graphite.

As lithium stocks begin correcting in 2022, there may be a smarter way to play the EV theme.

Learn about the ‘smarter way’ with lithium’s little brother.

Regards,

Kiryll Prakapenka