ASX developer Lake Resources [ASX:LKE] released its June quarter results on Friday.

The company’s share price was up 3% in late afternoon trade.

LKE shares have been under selling pressure this year, exacerbated by a critical report from J Capital.

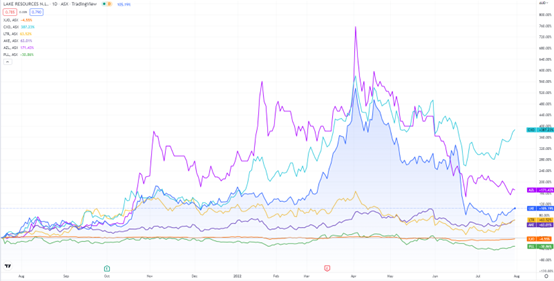

Year-to-date, LKE shares are down 20% but are still up 80% over the last 12 months:

www.TradingView.com

Lake’s quarter highlights

Lake updated the public on new joint coordinators for its debt financing of its Kachi Lithium project with investment banks Citi and JPMorgan, on completion of the competitive tender process.

The banks will work together on project milestones for such specifics as due diligence, JORC compliance, and environment and social assessments.

The company’s Definitive Feasibility Study (DFS) for 50,000 tpa lithium carbonate equivalent (LCE) at its Kachi project is expected to reach final drafts by the closing of Q3 2022.

Lake is currently in talks with the UK Export Finance (UKEF) and Export Development Canada (EDC) in support of around 70% financing required to expand its Kachi project.

The support is subject to standard project finance terms including offtake contracts, upcoming DFS results, and environment and social assessments.

Drilling continues at wholly-owned Olaroz and Paso projects, and the commencement of Kachi’s demonstration plant has begun ahead of commissioning in Argentina.

The demonstration plant will have a 3–4-month operational period where it will produce 2.5 tonnes high-quality lithium carbonate, derisking the project for offtakers, financiers, and investors.

The lithium produced at Kachi will be presented to offtake partners and undergo battery qualifications later in the year.

Lake reported that it’s well funded with a cash balance of AU$173 million by the end of the financial year, conversion options of AU$62 million in the June period.

Lilac Solutions, Lake’s technical partner, delivered a demonstration plant where plug-and-play ion exchange modules and supporting equipment are to be assembled.

LKE outlook

Lithium is facing a correction this year, but even so, many businesses are looking to create a stable environment for battery tech mineral producers looking to sell down the supply chain.

Why is the lithium-ion battery market ramping up to such a degree?

Vehicle manufacturers are madly securing supply chain deals while governments are throwing out initiatives and funding programs for support of battery production boosts across economies.

Our energy expert, Selva Freigedo, says that the global push to transition to EVs may result in a supply crunch.

There’s a new type of frenzy coming, are you prepared for it?

Luckily, Selva has recently released a report on the EV battery tech sector, complete with stocks to mark during the global push, and you can access it now — for free.