US-based lithium developer Anson Resources [ASX:ASN] reported increases in lithium grades as its drilling campaign continues at its Paradox Project in Utah, US.

ASN shares were up 8% in late Thursday trade, but down 4% year to date.

Source: www.tradingview.com

Anson’s Paradox Project: Further lithium grade increase

Today, Anson sought to update the public on its most recent drilling results at its Paradox Project in Utah, US.

Anson said drilling at one of the wells returned lithium grades ‘up to 70% higher’ than previously reported in fast-track assays in July.

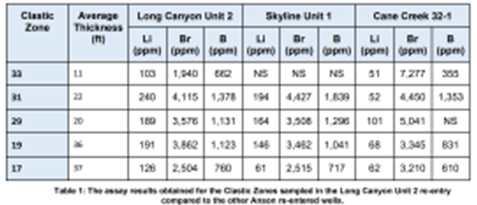

In detail, the latest lithium and bromine results at the Long Canyon No. 2 well were:

- ‘103ppm Li, 1,940ppm Br and 662ppm B in Clastic Zone 33 (11ft thick)

- ‘189ppm Li, 3,576ppm Br and 1,131ppm B in Clastic Zone 29 (18ft thick)

- ‘191ppm Li, 3,862ppm Br and 1,123 B in Clastic Zone 19 (38ft thick)

- ‘126ppm Li, 2,504ppm Br and 760ppm B in Clastic Zone 19 (46ft thick)’

ASN said an upgraded JORC Indicated and Inferred Resource is ‘planned to be confirmed in near future’.

Anson talked up the ‘unique’ location of its Utah project, stating:

‘The three factors; high pressure, porosity (both horizontal and vertical) and shallow depth are key attributes of the Project and are not present anywhere else in the area. In combination, they provide strong indicators of low extraction costs and beneficial ESG outcomes.’

Source: ASN

Anson’s Share Price Outlook

Last month, ASN shares jumped on a DFS update about its Paradox Lithium Project, when ASN claimed a boost in lithium production capacity to 10,000 tonnes lithium carbonate a year of battery-grade lithium.

This represented a 275% increase on production capacity reported in September last year.

Lithium mining — like much of the extractive sector — is an expensive business.

Even if lithium prices are elevated, that amounts to little if your extraction and processing costs are too high.

That’s why it’s important to own economic mines with lithium grades high enough to make mining worthwhile.

While Anson was pleased about the lithium grade found in samples at one of its wells, the key will be establishing economic grades across the whole project.

Battery tech metals in focus

Vehicle manufacturers are madly securing supply chain deals while governments are throwing out initiatives and funding programs for support of battery production boosts across global economies.

The US is making extra efforts in particular, allocating US$20 billion in low-interest loans while Biden campaigns the importance of a renewable-energy powered the US, and the steps to get his economy there.

Our energy expert, Selva Freigedo, says that the global push to transition to EVs may result in a supply crunch.

And as there’s a new type of frenzy coming, the question is, how can you play it?

Thankfully, Selva has just written a free comprehensive report on the EV battery tech sector, complete with stocks worth watching.

You can access ‘Three Ways to Play the Great EV Battery Race’, for free, here.

Regards,

Kiryll Prakapenka