Lithium junior Sayona Mining [ASX:SYA] said it was on track to recommence spodumene production in Q1 2023 at the North American Lithium (NAL) operation in Quebec.

Sayona said the NAL operation has ‘picked up speed’, with about 30% of plant and equipment upgrades completed.

The company having stated that its $190 million equity-funded North American NAL operation is on schedule for first production.

SYA shares were up 5% in late Thursday trade.

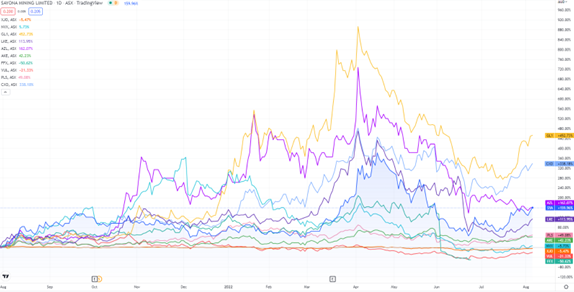

While up 100% in the past 12 months, the lithium stock is down nearly 50% from its 52-week high.

Source: www.tradingview.com

Sayona’s NAL project is back

This morning, Sayona reported that its North American Lithium (NAL) project in Québec is on track to recommence production in Q1 2023.

Sayona said the NAL operation has ‘picked up speed’, with about 30% of plant and equipment upgrades completed.

SYA reported that construction work is on schedule, with 50 construction workers on site, that number is expected to double by September.

Sayona has committed about $100 million to the restart.

Having started the June quarter with $19.8 million in cash, Sayona ended the quarter with $195.7 million after issuing more than $190 million in new shares.

SYA has now received important equipment for the project, billed to June commitments, including magnetic separators, crushers, derrick screeners, and ore sorting conveyors.

SYA reported contingency plans are in place to work around supply-chain issues and delays in commissioning activities.

Sayona’s Managing Director Brett Lynch commented:

‘It is extremely pleasing to see the rapid progress at NAL as we ramp up towards the recommencement of lithium production.

‘With virtually all of the NAL operation powered by hydroelectricity, this is truly one of the world’s most sustainable lithium operations, an important ESG differentiator in an industry that aims to facilitate global decarbonisation.’

Ways to play the EV revolution: lithium is just one

The electric vehicle (EV) market is rapidly expanding, boosted further by government initiatives and funding programs supporting production across the globe.

But our energy expert, Selva Freigedo, thinks the global transition to EVs means the industry faces a supply crunch, which can send prices for battery materials soaring even higher in 2022 and beyond.

If you’d like to know more, I suggest checking out Selva’s battery tech metals report for free here.

Regards,

Kiryll Prakapenka