Communications intelligence provider Whispir [ASX:WSP] released its FY22 results on Wednesday, saying it was on track for positive EBITDA in FY23.

Whispir also announced it posted record full-year revenue of $70.6 million, up 48% on FY21.

Net loss widened 101% to $19.4 million.

Despite the record revenue performance in FY22, WSP shares were largely flat on Wednesday.

WSP shares are down 45% year-to-date.

Source: www.tradingview.com

Whispir on track for positive EBITDA in FY23

Here are Whispir’s key FY22 results:

- ‘Record revenue of $70.6 million – up 48% on the prior corresponding period, FY21 (PCP)

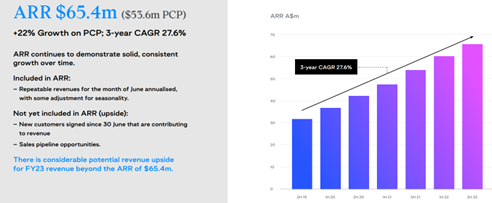

- ‘Strong 3-year CAGR growth of key revenue metrics – revenue 31.4% & ARR 27.6%

- ‘Operating expenses reducing with Q4 down 11% on Q3 reflecting a successful efficiencies program

- ‘EBITDA loss of $10.6 million ($3.8 million loss in PCP), better than expectations

- ‘Strong balance sheet with cash of $26.1 million and no debt, well-funded through to profitability expected in FY23 and cash flow positive during FY24’

Whispir’s $70.6 million exceeded the company’s original guidance, and attributes the 48% growth on platform expansions in Australia and NZ.

Revenue increased 56% to $62 million in the ANZ segment, which WSP attributes to government-controlled vaccine rollouts.

Source: WSP

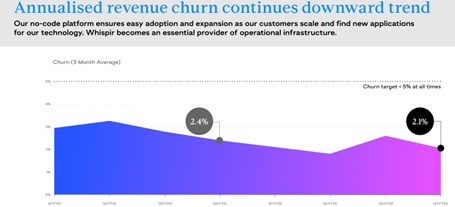

Another element to outperform was the company’s net revenue retention, which went up 125.5% while revenue churn, at 2.1%.

Whispir also noted its progress in expanding its customer base via contracts with the Department of Education in South Australia (spanning 900 schools), government departments (including transport safety assistance), a telco partnership in Asia, and 233% customer growth in North America.

Source: WSP

While top line growth was strong, WSP’s net losses widened just as strongly.

Whispir ended FY22 with a net loss of $19.4 million, up 100% on FY21.

Having started the year with $49.2 million in cash and cash equivalents, Whispir ended FY22 with $26 million after more than $20 million in negative free cash flow.

Commenting on the company’s results for 2022, Whispir’s CEO Jeromy Wells said:

‘Whispir has again delivered a strong financial performance, with record revenues secured while reducing operating expenses in Q4. Our strengthened leadership team has contributed to Whispir’s continued success as we set our sights firmly on becoming EBITDA positive in the second half of FY23.

‘Over the period we secured a number of significant customer signings, including a strategic telco partnership that will accelerate growth in the Asian market and protect our customer base in the region.

‘Governments, enterprises and other organisations are now clearly committed to a future where digitisation plays an essential role in ensuring communications are targeted, efficient and effective.’

WSP share price outlook

CEO Wells concluded by noting:

‘With leading global brands and governments continuing to endorse Whispir’s product, we are very confident about where Whispir is headed.

‘We have a market-leading platform, a proven strategy of both onboarding new customers and increasing platform usage by existing customers, as well as an ambitious and dedicated leadership team that is ensuring we continue to drive growth while simultaneously improving efficiencies and managing expenses prudently.

‘Low revenue churn combined with high net revenue retention reflects the appeal and multiple applications of the Whispir platform. We are motivated by our opportunities to scale in the year ahead and to becoming EBITDA positive in the second half of the current financial year.’

EV battery tech and Elon’s chosen ones

And while Mr Wells spoke of governments, enterprises, and other organisations being committed to a future of digitisation, so too are these institutions focused on a green future and green tech.

It can be a challenge to find opportunities in current market conditions.

But opportunities, like the EV battery industry, are out there.

Our small-cap expert Callum Newman has found three battery stocks that he believes have the potential to be the next ‘chosen ones’ for leading battery mineral supply chains.

You can find out more by reading Callum’s report here: ‘Elon’s Chosen Ones’.

Regards,

Kiryll Prakapenka