This is Fat Tail Daily’s comprehensive guide to investing in renewable energy in Australia.

In it we cover:

- What is renewable energy?

- Types of renewable energy

- Australia’s changing mix of energy generation

- Drivers of investment in renewables

- Are renewables a good investment?

- Things to consider before you invest in renewable energy

- How to invest in renewable energy

- An introduction to renewable energy stocks on the ASX

What are renewable resources?

Renewable energy is produced using natural resources that are constantly replaced and never run out.

For example, wind and sunlight are abundant and all around us.

On the other hand, fossil fuel sources such as oil, which come from decomposing plants and animals, take hundreds of millions of years to develop.

While renewable energy has been around for thousands of years — our ancestors, for example, harnessed wind to power sailboats or grind grain — most of our energy today comes from fossil fuels.

But renewables have been gaining ground in recent years.

In 2021, wind and solar generated over 10% of the world’s global electricity, double what they were producing in 2015.

The International Energy Agency expects that renewables will become the largest source of global electricity as soon as 2025, passing coal.

The shift from fossil fuels to renewables will change the way we power our homes, our transport and our industries.

We are in the midst of an energy transition. But before we look at what’s driving the change, let’s take a deeper look at the types of renewable energy first.

What are the Different types of renewable energy?

Solar Power:

Is probably one of the most well known renewable energy sources, though wind power is the most widespread in Australia.

Generally, solar power is generated by two methods: small-scale generation (think of solar panels on your roof), or large-scale projects like solar farms.

Wind Energy:

Our old wooden windmills have developed into tall turbines with long blades that harness wind energy, which then feeds into an electric generation to produce electricity. This is one of the main renewable resources in Australia, generating 9.5% of Australia’s total electricity and 35.4% of the country’s clean energy in 2019.

Hydropower or Hydroelectricity:

Solar Power: Is probably one of the most well-known renewable energy sources.

Generally, solar power is generated by two methods: small-scale generation (think of solar panels on your roof), or large-scale projects like solar farms.

Wind Energy: Our old wooden windmills have developed into ever growing tall turbines with long blades that harness wind energy. This then feeds into an electric generator to produce electricity. Along with solar, this is one of the main renewable resources in Australia.

Hydropower or Hydroelectricity: Hydropower captures the energy of running water to turn it into power. It is one of the oldest forms of renewable energy. Australia’s Snowy Mountains hydroelectric dam completed in 1974 is a great example of this.

Bioenergy: Is a form of renewable energy that uses organic materials to produce heat, electricity, biogas, and liquid fuels. An example can include burning wood, or using crops such as corn or sugarcane to produce biofuels.

While bioenergy emits greenhouse gasses, it’s far less taxing on the environment in terms of overall pollution in comparison to fossil fuels.

Geothermal Energy: Converts heat from inside the earth to generate electricity and heating.

Ocean Energy: Harnesses the energy of the tides and waves through a variety of developing technologies. Converting the temperature difference between the ocean’s surface water and deeper water into energy generates ocean thermal energy.

Australia’s changing mix of energy generation

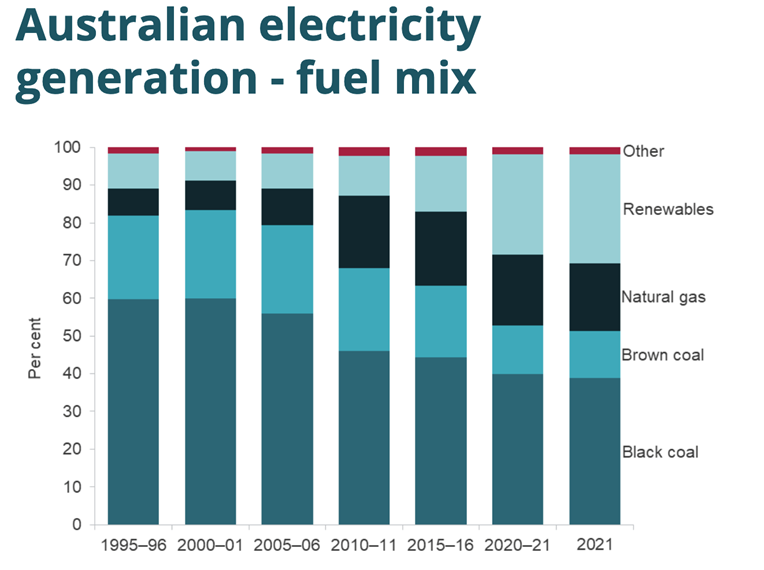

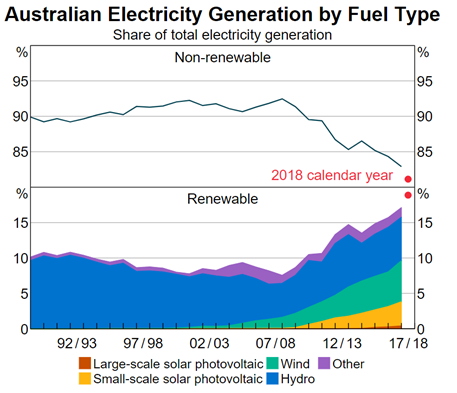

The growth of renewable energy as part of Australia’s energy mix has increased drastically over the last decade, making up about a 30% share in 2021.

Source: Energy.gov.au

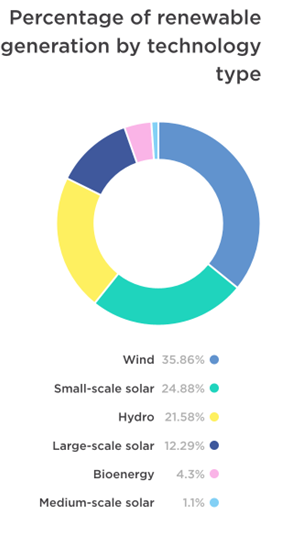

As you can see in the graph below, wind has a 35% stake when it comes to renewable generation, the largest share.

Source: Clean Energy Council

But perhaps one of the most interesting points to note is the large segment of small-scale solar energy production.

Households have been the main driver of small-scale renewable investment and at time of writing over three million Australian households, or about a third of the country’s dwellings had been fitted with rooftop solar panels.

The rise of renewable technology has allowed people to generate their own electricity and even be paid to supply the grid.

Unsurprisingly, Australia’s rising energy costs have been a strong driver of this type of investment.

This is important to note, as it will have a continued impact on the types of renewable energies that receive investment, as well as electricity grid and energy storage investment.

So, what will drive investment in green energy in the future?

Drivers of renewable energy investment

2022 was a record year when it comes to global investment in renewables.

Investment in renewables hit US$495 billion for the year, a 17% increase from 2021, according to Bloomberg NEF.

There’s been a number of factors driving investment into renewable energy. Some of these include the lower cost of renewable energy, government policy and high electricity prices.

An important driver for renewables has been economics.

Renewable energy costs have fallen quickly in the last decade, much quicker than expected.

Between 2009 and 2019, wind energy prices fell by 70% and solar photovoltaics prices decreased by 89%. In fact, solar prices dropped so much that the IEA went as far as labelling solar the ‘cheapest electricity in history’.

A recent study by UK’s Oxford University and Australia’s Monash University found that shifting from fossil fuels to renewable energy and green hydrogen could save the world US$18 trillion by 2050.

As the lead author of the study Dr. Rupert Way put it:

‘Clean energy costs have fallen sharply over the last decade, much faster than those models expected. Our latest research shows scaling-up key green technologies will continue to drive their costs down, and the faster we go, the more we will save.’

‘Accelerating the transition to renewable energy is now the best bet, not just for the planet, but for energy costs too.’

Another main factor powering investment into renewables has been government policy.

In recent years governments have continued to pledge for more ambitious energy targets for the energy transition.

Australia plans to reach net zero emissions by 2050. Our major trading partners are also looking at shifting the way they produce energy. US President Joe Biden, for instance, has committed the US to reach net zero emissions by 2050 at the latest.

Our largest coal markets China, South Korea and Japan have said they’ll go carbon neutral by 2050 or 2060.

Government policies are expected to contribute heavily to future investment in renewable energies.

But while the renewable energy transition is good for the planet, it’s about more than that. What’s driving the energy transition is lower energy costs and energy security.

The Ukraine-Russian war that started in February 2022 sent energy prices soaring. Yet if the conflict made anything clear is that renewable energy is the solution to increasing energy security.

As the International Energy Agency (IEA) put it in their Renewables 2022 report:

‘Renewables were already expanding quickly, but the global energy crisis has kicked them into an extraordinary new phase of even faster growth as countries seek to capitalize on their energy security benefits.’

Renewable energy is abundant and cheap. Almost every country can, in some capacity, produce renewable energy. It can provide diversification and reduce the need of energy imports.

The quest for energy security has sent countries in a race to secure renewable energy supply chains. At the moment though, those are pretty concentrated in a handful of countries.

For example, Australia together with Chile hold close to 70% of the global lithium extraction and the Democratic Republic of Congo has close to 70% of the world’s share of cobalt production.

Not only that but China dominates when it comes to battery and solar panel manufacturing.

The US and Europe, for instance, have both been investing in building up their domestic renewable energy supply chains.

So in short, government policy, economics, high energy prices and a need for energy security are all driving investment into renewables. It’s all rounding up to build a decent case for investment in renewables.

But that doesn’t mean there is no risk.

Things to consider before you invest in renewable energy

Let’s consider some of the risks that investing in renewable energy stocks might expose you to.

In many industries the risks posed by nascent technologies is considered to be some of the most significant.

In the renewable energies sector, understanding the risks emerging technologies provide is particularly relevant.

While the basics of capturing energy from renewable sources is well understood, some firms trading on the stock market develop or manufacture emerging renewable technologies that are for the most part untested.

What’s more, many of these are considered growth stocks, so they’ve been subject to recent market volatility as central banks have been raising rates.

In fact, renewables are also vulnerable to interest rate increases. This is because clean energy assets have high upfront investment costs and lower operating costs over time.

Also, understanding government policies and regulations is imperative to making informed investment decisions.

As we discussed earlier, government policies have been a key driver for investment in renewable energy and without it some firms or projects may cease to be.

This is not an exhaustive list either, so it is important you do adequate research before deciding on any specific investment.

How to invest in ASX renewable energy shares

One important thing to realize is that renewable energy investing encompasses a very broad area.

It includes solar, wind and hydro but also companies in many other sectors such as mining, energy storage, and clean tech just to name a few.

Perhaps the easiest way to invest in renewable energy is through an exchange traded fund (ETFs). ETFs function like individual stocks, but they are actually a combination of dozens of different stocks.

And there are several on the ASX.

For instance, if you are looking for an ETF that gives you general exposure to clean energy stocks, you can look at the VanEck Global Clean Energy ETF [ASX:CLNE].

The ETF follows 30 of the largest global companies in clean energy, including Plug Power, First Solar and Vestas to name a few.

Or, if you are looking for an ETF in a more specific area in the renewables sector the Betashares Energy Transition Metals ETF [ASX: XMET] tracks global companies involved in the raw materials needed for the energy transition. It includes global producers of metals such as copper, lithium, nickel and cobalt to name a few.

The Betashares Solar ETF [ASX:TANN] tracks global companies in the solar industry such as Sunrun, Tesla and SolarEdge Technologies.

But probably the most popular method for investing in renewable energy is through investing in stocks directly.

There are many renewable energy-related stocks currently trading on the ASX. But keep in mind that this is very much a global story so it may be worth looking at stocks outside the ASX too.

As mentioned, these stocks can range from companies developing large scale renewable projects to miners that produce minerals specifically for use in clean energy technology, to wind and clean tech.

Genex Power Ltd [ASX:GNX], for example, is developing several renewable energy and storage projects around Australia and Meridian Energy Ltd [ASX:MEZ] is New Zealand’s largest 100% renewable generator and its portfolio includes solar, wind and hydro plants.

On the other hand you are looking at investing in critical minerals, you can look into diversified miners such as IGO Ltd [ASX:IGO], a Western Australian company with exposure to gold, nickel, copper and lithium. Or at miners that target one particular resource such as Pilbara Minerals [ASX:PLS], a lithium miner.

Another example is ClearVue Technologies Ltd [ASX:CPV], who has been busy developing solar glass panels that can be used in buildings or in cars that have the capability to produce electricity.

Note: None of the stocks we’ve mentioned are official recommendations. Just examples of renewable energy-related stocks for your consideration.

What to make of renewable energy investments

We hope you’ve enjoyed this comprehensive guide to investing in renewable energy in Australia.

Getting in earlier can offer investors nice returns, but also exposes them to significant risk.

As the sector develops and becomes more mainstream, the riskiness of renewables will likely wane.

Remember, if you want to stay clued up on all things of interest within the investment landscape, including renewable energy-related stories, be sure to subscribe to Fat Tail Daily. It’s a unique publication that exists to cut through the hype to help you make sense of the stories that really make a difference to your wealth — aiming to make you a more informed, enlightened and profitable investor.