Updated January 2023

This is a comprehensive guide on Bitcoin [BTC], for you to learn exactly what bitcoin is and how it works.

Whether you are for or against bitcoin, its rise to prominence has been well documented and as an investor, it’s important to understand the most popular form of cryptocurrency and how it works.

To some, bitcoin and cryptocurrencies represent the future of money, while others believe it to be ‘phony’ or just a speculative fad.

So, let’s dive deeper into bitcoin and clear up any confusion.

This guide covers the following:

- What is bitcoin?

- Who created bitcoin and why?

- How does bitcoin work?

- How to buy bitcoin in Australia

- The bitcoin price — how much is bitcoin worth?

- Bitcoin as a currency (for transactions/payments)

- Mining bitcoin

- How to invest in bitcoin

What is bitcoin?

At its core, Bitcoin is a cryptographically secured way of keeping track of transactions via a public ledger.

The term cryptocurrency is derived from the ancient Greek word kryptos, meaning hidden or secret and currency, meaning money.

So, in some ways, you can think of cryptocurrency as ‘hidden money’.

The key thing to remember is that Bitcoin doesn’t need a central coordinating authority, i.e., a bank or financial institution.

Bitcoin is a peer-to-peer-based system with transactions taking place between the two parties without the requirement for an intermediary such as a bank.

Unlike a bank, where all monies are kept in one place, and a record of movements is kept, Bitcoin operates on a public ledger that everyone has access to.

Each transaction is on the public ledger and verified by a huge amount of computing power known as a blockchain.

Bitcoin is not physical in the sense that there are only balances that are kept on a public ledger, along with a record of all transactions.

Bitcoin and other cryptocurrencies, such as Ripple or Ethereum, differ from traditional currencies in that they are not backed or issued by any government.

Which in many ways is part of its appeal, given recent trends in monetary policy.

Bitcoin is not alone in the world of cryptocurrency, though, despite its status as ‘the original and the best’.

There’s also an entire ecosystem of ‘altcoins’ that offer different takes on the underlying principles that Bitcoin popularised, each with unique pros, cons, and projects.

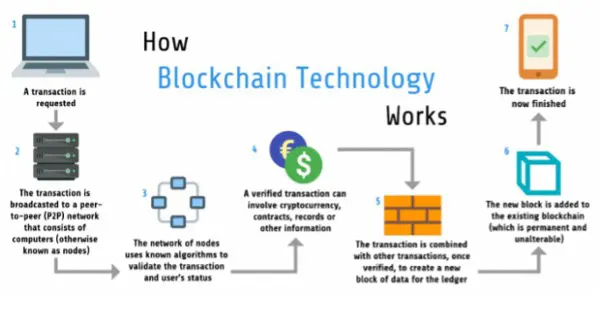

What is blockchain?

All cryptocurrencies operate on a blockchain system.

Blockchain, at its core, is a database. To understand blockchain, first, we need to understand what a database is and does.

A database is a collection of information stored electronically. They are usually structured and formatted in a way that makes it easy for the user to retrieve information.

There is a distinction to make here. You may read the above statement and assume something such as a spreadsheet is a database.

The difference is spreadsheets are generally designed to be used and manipulated by only a handful of people, whereas a database is built to hold much larger amounts of information.

A database can be accessed, filtered, and manipulated quickly by any number of users at once.

Databases are generally housed in large servers made up of many powerful computers.

The number of computers in the server can be expanded to meet the computational power and storage capacity requirements so multiple users can access the server at any one time.

The difference between a database and a blockchain is the way the data is structured.

Blockchain puts information into groups. Each group is known as a block.

Each block has a certain storage capacity for information. When a block is filled, it’s chained to an already filled block.

A continuously linked system that extends through time.

This forms the blockchain.

Any new information added will go into a new block and, once full, will be chained to the previous block.

A traditional database complies all information into tables, whereas blockchain (as the name implies) holds its information in blocks that chain together.

A blockchain also makes an irreversible timeline of data — there is no going back and revising it (in theory).

When a block is filled, it’s in place for good and becomes a part of this timeline.

Every block in the chain is given an exact timestamp of when it’s added to the chain.

Source: pintrest.com

Who created bitcoin and why?

Created in January 2009 following the housing market crash, bitcoin follows the ideas set out in a whitepaper written by Satoshi Nakamoto.

Satoshi Nakamoto’s identity remains a mystery to this day.

Bitcoin was created to solve the problem Satoshi Nakamoto saw in the banking system.

The trust-based model — a system of trust between two parties and using an intermediary such as a bank — cannot have a system of a completely non-reversible payment for a non-reversible service.

The inherent problem with the trust-based model outlined in the whitepaper is that completely non-reversible transactions are not completely possible.

This can lead to fraud. A certain amount of fraud is accepted as unavoidable and factored into the cost of using a third party such as a bank.

Banks and financial institutions then have to mediate disputes between two parties from time to time.

Hence, banking fees.

Satoshi Nakamoto proposed and created Bitcoin to eliminate this problem. Transactions done through a peer-to-peer network are impractical to reverse due to the computational complexity.

By removing the ability to reverse payments would protect participants from fraud.

The contrast between Bitcoin and the traditional model of fiat (government-issued) currency is even more stark in the current climate.

On the one hand, you have Bitcoin’s ‘proof-of-work’ system versus the trust-based fiat system.

2020 saw the world economy contract dramatically under the weight of a global health pandemic.

Central banks around the world then cut interest rates to support their respective economies.

Coupled with this, global wage growth is also very low.

Enter bitcoin, as fiat currency enters the age of a ‘global currency war’ characterised by easy money flowing from central banks.

Create more of something, and suddenly, its value starts to slip, naturally.

Quantitative easing (QE) is where governments buy assets to steady the ship, which doesn’t help the trust-based system either.

Artificially created asset values and market manipulation tend to erode trust in the fiat system.

How does bitcoin work?

Bitcoin operates on a peer-to-peer (P2P) network:

Peer-to-peer is the exchange or sharing of information, data, or assets between parties without the involvement of a central authority.

The P2P network is decentralised.

The digital P2P network makes each user of the network an equal owner and contributor to the network.

This is a completely different approach from the normal trading of stocks.

When trading stocks, the buying and selling of the stock happens through a central exchange.

Bitcoin removes the third party.

Doing this through a decentralised P2P network is a fundamental feature of cryptocurrencies such as Bitcoin.

You don’t actually own a physical coin. Rather, the information regarding all the transactions (who owns each coin/portion of which coin) is stored on a public ledger.

Bitcoin can be broken down into parts, with multiple owners holding parts of one coin.

The smallest unit is a satoshi, representing one hundred millionths of a bitcoin (0.00000001).

This allows for minuscule transactions that traditional money is unable to perform.

The way Bitcoin is stored is also unlike a traditional account.

With a banking account, a transaction takes place between two parties with the bank or financial institution in the middle of the two.

The bank facilitates the transaction between the two parties.

Bitcoin operates on a P2P basis, with each user having a wallet.

A wallet is identified by a string of numbers.

When party A wants to send Bitcoin to party B, they do so by sending it to the public wallet address (a string of numbers) for party B.

Party B can then access it using their private key. The problem with this system is that if you lose or forget your private key, it’s gone for good. There is no way to regain it.

Therefore, losing access to your wallet and whatever Bitcoin may be in it.

How to buy bitcoin in Australia?

The first thing to know in buying Bitcoin is knowing its code among other cryptocurrencies.

Bitcoin is represented by the code BTC.

There are a couple of ways to buy Bitcoin. You can go through an exchange, or it can be bought through a marketplace.

Like most things, there are many ways to pay for Bitcoin. You can use cash, credit card, wire transfer and other cryptocurrencies.

The first thing you will need to do is set up your wallet — it is very important you get this step right and protect your private key.

Remember, if you lose your private key, you lose your wallet.

Whoever controls the private key controls your Bitcoin. That can’t be stressed enough.

Understanding wallets can be a topic all by itself, which we will discuss in greater depth in a moment.

As the rapid rise and fall between 2021 and 2022 proved, Bitcoin can be volatile. Never buy or invest more than you can afford to lose!

Buying Bitcoin — there are a number of exchanges available, and the best thing to do is research.

There are some things to keep in mind when looking for an exchange.

- Liquidity — Bitcoin is decentralised, so there is no real one-defined price that every exchange follows. To be able to get the best or closest prices for Bitcoin when buying or selling, finding an exchange with excellent liquidity is a must. The better the liquidity, the easier it is to buy and sell quickly.

- Security — Bitcoin in the past has been used for criminal activity. Most reputable exchanges these days will focus on KYC (know your customer) and AML anti-money laundering laws. The reputable exchanges will likely require you to verify your account via ID documents before you can trade or invest. Photo ID and proof of address are the standard requirements.

- Country of origin — Where the exchange you choose is operated may dictate the currency they trade and quote in. For example, if the exchange is located in the US, they will most likely use US currency. You will need to be aware of the exchange rate between AUD and USD so you fund your account with the right amount of AUD. That will exchange for the right amount of USD to buy the Bitcoin you want.

- Costs — Like any other system, there are fees and costs associated. Before you go jumping into the first exchange you find, read up on the fees. With the exchange rates, fees, and inherent volatility of Bitcoin, if you are not careful, you may lose a lot before you notice what’s happening.

How to invest in bitcoin?

In 2014, the Australian Taxation Office determined that Bitcoin and other cryptocurrencies are not money but are capital gains tax assets.

As such, Bitcoin and other cryptocurrencies can now be added by investors to self-managed superannuation funds (SMSF).

Bitcoin and other cryptocurrencies do not normally generate an income (however, with some cryptocurrencies, it’s worth looking into staking if this interests you). As a result, the expectation behind the investment strategy is the cryptocurrency’s growth in value.

For this reason, the ATO considers Bitcoin and other cryptocurrencies as an asset. If the asset is sold for a profit, it may attract a capital gains tax.

Conversely, if the asset is sold at a loss, then a capital loss may be triggered.

The cost of trading cryptocurrencies cannot be claimed as a tax deduction.

If this is something you are considering doing, the first port of call would be to seek financial advice to make sure you understand the risk, how it all works, your own tax implications and if it is the right investment for you.

The Bitcoin price — how much is Bitcoin worth?

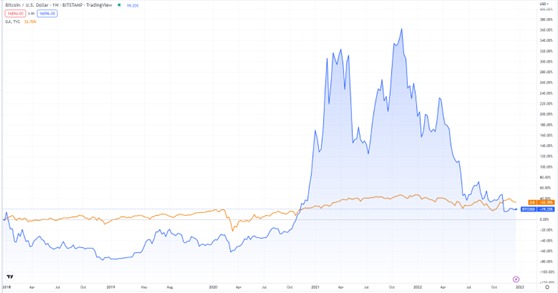

Now we have touched on the history of Bitcoin, where it came from, how to get it, some of the risks and how to invest…it’s time to talk about the price.

You can see the history of BTC in USD since 2015 below:

Source: CoinDesk

There have been some wild swings in the bitcoin price over its lifetime. At times, falling just as quickly as it rose.

There were periods in 2021 and 2022 that saw the BTC price move up — and drop — rapidly.

Apart from the rapid movements in the price movement, there are some things to know about the price itself.

Again, being a decentralised currency means that not all exchanges will have the same price for bitcoin. Different exchanges around the world may offer different prices and movements in the price.

The price for Bitcoin can also be very ‘news sensitive’, making for a very speculative and volatile marketplace.

A good example of this volatility can be seen below when comparing the Dow Jones Industrial (DJI) to the peaks and troughs of Bitcoin over the past five years:

Source: Tradingview

Since December 2021, Bitcoin has struggled to rise to the same benchmark as the Dow Jones market average.

At the time of writing, bitcoin holds a market cap of more than US$325.5 billion. This may seem large, but when compared to a company such as Amazon — with a market cap of US$870 billion, it’s got a long way to go.

BTC’s market cap has also nearly halved since early 2021, when it was then at US$600 billion.

Having said that, Amazon’s market cap has also dropped in the recent volatility of the market. It boasted a US$1.608 trillion market cap in early 2021.

Bitcoin as a currency (for transactions/payments)

The increasing popularity of Bitcoin is seeing the currency more widely accepted as a payment method both online and in the physical world.

More and more brick-and-mortar stores are starting to accept Bitcoin as a payment method.

From hotels and restaurants to bike stores.

Even global companies such as Microsoft take Bitcoin as payment.

Businesses that accept Bitcoin as payment may be required to pay tax on any earnings, the same as they would any other payment they receive.

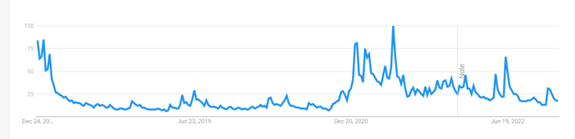

The payment side of Bitcoin and other cryptocurrencies was recently taking a back seat to the price action of the asset.

As seen in the chart above, the price for bitcoin has been decreasing the further it journeyed through 2022.

However, during the pandemic, traders and investors were flocking to Bitcoin.

The wild fluctuations in price were presumably steering some away from wanting to use it as a payment method.

And with it moving lower and lower in value over recent months, it’s not likely Bitcoin holders will be looking at spending it now either.

Check out the history of Google searches for Bitcoin below:

Source: trends.google.com

As we can see, the price of Bitcoin can fall at an alarming rate.

If a business were holding a lot of bitcoin or cryptocurrency it had accepted as payment, should the price crash when exchanging it for fiat currency, they may well end up with a lot less money than they sold their goods for.

However, while it can fall at frightening speed, it could also rise at a similar speed in the future.

Mining Bitcoin

Mining for bitcoin and cryptocurrencies is an integral part of the crypto ecosystem.

In the old days, mining for gold was all the rage.

Mining for Bitcoin can be seen as a modern-day version. Like the gold rush, to mine for Bitcoin a series of difficult computational tasks must be performed in order to be rewarded small parts of Bitcoin.

Bitcoin mining is performed by high-power computers that solve complex cryptographic math problems.

Two things take place when mining for Bitcoin.

First, when the computers solve the maths problem on the Bitcoin network, the result is the production of new Bitcoin.

Secondly, by solving the maths problem, the miners help make the network more secure by verifying transaction information.

For the miners, by helping to make the network more trustworthy, they are rewarded with Bitcoin.

Miners are a very important part of the Bitcoin and cryptocurrency system.

When a Bitcoin is sent anywhere, it is called a transaction.

These transactions need to be verified and placed together in groups called a block.

Once a block is complete, it’s added to the public record or the blockchain.

The relationship between Bitcoin and its underlying blockchain and the miner is one of symbiosis.

They both need each other to survive.

The miner requires Bitcoin, and the system requires computational power to perform the task of verification.

Buying and investing in Bitcoin and cryptocurrencies.

As we discussed, there are numerous ways to buy or invest in bitcoin and cryptocurrencies.

Have a quick look at the BTC price action over the last three months of 2022:

Source: Coin Market Cap

The price of bitcoin dropped below US$18k by early November 2022 and remained below this line towards the end of the year.

It is possible for Bitcoin to be due for a change in the next two years, with its tendency to cycle every four years, and each cycle it hosts a ‘halving event’.

A halving event is when the reward for bitcoin miner transactions is cut in half, reducing the rate at which new coins are released to the market, lowering available bitcoin and driving up the price.

If buying Bitcoin or cryptocurrencies is something you are considering investing in, there are some factors to consider:

- Your tolerance for risk — being a volatile asset, you may lose more than you can afford.

- The amount of capital of your overall portfolio you are willing to assign to bitcoin or crypto.

- Does your personality or investment style line up with the asset you are wanting to trade. In this case, bitcoin. Fast-moving and volatile — if you have a more conservative approach to investing, this may not suit you.

- Lastly, but most importantly, your plan to enter and exit the investment and stop-losses to protect your profit.

As proved by the extreme rise and fall in price from 2021–22, bitcoin and the overall crypto market can be very volatile.

Those looking at any cryptocurrencies should be aware of not only the nature of the investment but also the inherent risk involved.

If you are looking to buy Bitcoin and other cryptocurrencies or use them in your business as a method of payment, the same level of risk applies, if not more so.

As a business, you are required to pay your suppliers in a fiat currency in most instances. If you are accepting large amounts of bitcoin or cryptocurrency as payment from customers and there is a price drop, you may be left with a large financial gap between what you have been paid and what you owe your suppliers.

The price movements in Bitcoin and cryptocurrency can be wild and volatile at times, leading to unforeseen losses if not managed correctly.

Be sure that if this is an area you are looking to get into, you have a working understanding of not just the risks involved, but also how Bitcoin and cryptocurrencies came to life and their operations as well.