The Galaxy Resources Ltd [ASX:GXY] share price reached a 52-week high after record quarterly production of 63,321 tonnes of lithium concentrate.

GXY shares were up 11% on the back of the result at time of writing.

Along with the record production in the quarter, Galaxy also managed to bring down its unit cash operating costs by 17%.

Orocobre Ltd [ASX:ORE] — who is set to merge with Galaxy Resources later this year — also released positive quarterly results.

ORE shares also surpassed their 52-week high after the lithium stock posted growth in production and sales.

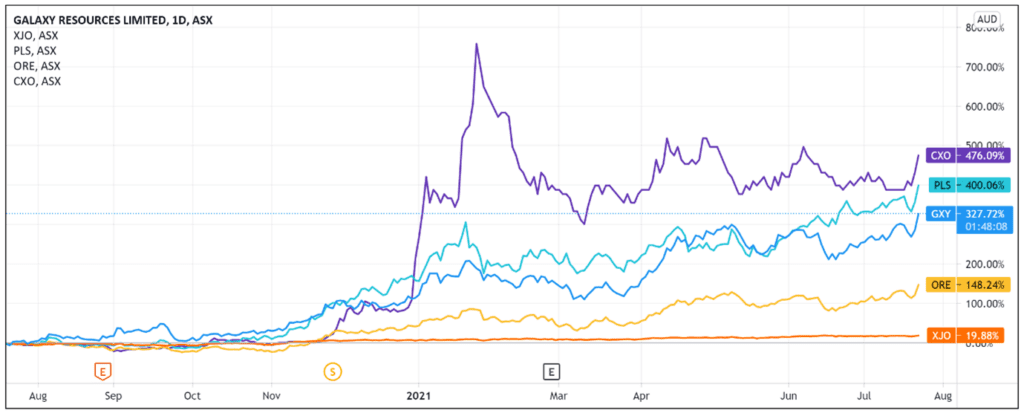

Orocobre and Galaxy share prices are both up more than 150% over the last 12 months.

Record quarterly production

Here are the key takeaways from Galaxy’s June quarterly.

GXY’s Mt Cattlin project in Australia:

- Record quarterly production of 63,321 dry metric tonnes (dmt) of lithium concentrate, with specifications ‘in line with customer requirements.’

- Unit cash operating costs for the quarter totalled US$328/dmt — 17% lower than the previous quarter.

- 48,499 dmt of lithium concentrate shipped in the quarter.

- A further two shipments of 31,500 wet metric tonnes were completed in July.

Galaxy attributed the record production to favourable head grades, and better plant utilisation and faster processing rates.

Regarding its Sal de Vida project development in Argentina, Galaxy said that Stage 1 production wellfield drilling continues. And five out of eight wells have already been successfully installed.

Importantly, onsite piloting produced ‘battery grade lithium carbonate with far lower impurities than previous results.’

Galaxy said its projected costs and schedule remain ‘on track and in line with previous guidance.’

Galaxy’s finances in order

Galaxy revealed that as of 30 June 2021 it was debt-free, holding US$208 million worth of financial assets.

The company also has an undrawn US$40 million debt facility that matures on 31 December 2021.

GXY and ORE ASX Share Price Outlook

As I’ve covered earlier this year, the growing adoption of electric vehicles is pushing lithium prices higher.

So if companies like Galaxy and Orocobre can operate efficiently at full rate, they stand to benefit from hot demand and rising prices.

GXY already pointed out that Q3 contracted shipments for 60,000 tonnes of lithium concentrate from Mt Cattlin are ‘well advanced’.

And the lithium price hikes can be seen in ORE’s latest quarterly update.

ORE reported that the average price it received per tonne in the June 2021 quarter was 45% higher than the price fetched in the March 2021 quarter.

Not only that, compared to the June 2020 quarter, the average price ORE received rose 117%.

GXY and ORE are tracking well right now, and attention will likely shift to the finalisation of their merger and how the two companies work together.

As today’s price movements show, lithium stocks are riding a strong wave of interest recently.

Governments are eyeing off a greener future while enterprises are eyeing off profitable ways to accelerate this future.

Lithium is at the core of this as the white metal is a key part of the global EV supply chain.

Therefore, if you want more information on a sector enjoying resurgence, I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning

PS: This free report reveals three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.