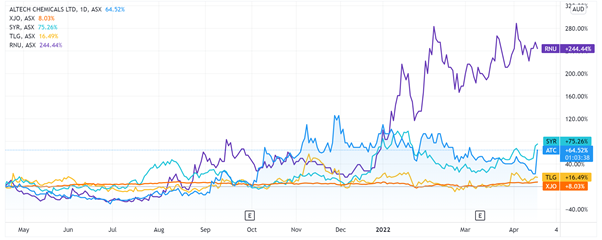

Altech Chemicals [ASX:ATC] shares are up 34% following ‘outstanding PFS results’ for its Silumina Anodes Project.

Due to the big spike, ATC is now trading at 10 cents a share, with Altech shares now up 70% in the last 12 months.

Graphite stocks are getting traction lately, with Syrah Resources [ASX:SYR] shares rising on Wednesday after the US government announced a conditional commitment to loan Syrah US$107 million.

While lithium is still the dominant battery tech theme, can other battery tech materials — like graphite — share the limelight?

Source: Tradingview.com

ATC’s outstanding Silumina Anodes PFS results

Altech today announced ‘outstanding PFS results’ for its green 10,000tpa Silumina Anodes Project, a project projected to have capital costs of US$95 million.

ATC purchased its German site in Saxony, which purports to have high-quality supplies of graphite and silicon.

Silumina’s Pre-tax Net Present Value is estimated at US$507 million, with a 40% Internal Rate of Return.

Altech currently trades at a market capitalisation of around $140 million.

US$63 million a year in net cash is expected to be generated from Silumina’s operations, but with 10,000tpa, the total rate of production is estimated at US$185 million annually.

Engineering for Altech’s pilot plant and products has begun, with two German automakers and a European battery manufacturer agreeing to unofficially partner with the project.

The project can be undertaken with exclusive licencing, enabling ATC to produce Silumina Anodes to supply the growing European electric vehicle market.

Altech share price outlook — silicon appeal

Altech cited EV giant Tesla as saying that the ‘required step change to increase lithium-ion battery energy density and reduce costs is to introduce silicon in battery anodes.’

According to Tesla, incorporating silicon into battery anodes should generate 10 times the energy retention capacity of graphite.

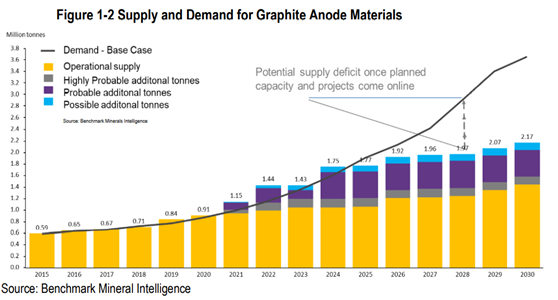

Altech went on to say that ‘silicon metal has been identified as the most promising anode material for the next generation of lithium-ion’, which explains ATC’s aim to develop the Silumina silicon/graphite project.

Source: Altech

Altech Managing Director, Mr Iggy Tan, said:

‘Whilst Altech’s top priority continues to be financing its Johor HPA project, the Silumina Anodes project represents an exciting downstream opportunity to utilise its HPA coating technology in silicon/graphite battery materials.

‘We are pleased and excited about the results of the 10,000tpa Silumina Anodes PFS. Due to the attractive economics of the study, a decision has been made by the AIG board to immediately progress to a definitive feasibility study (DFS) for the project.

‘AIG has already purchased land in Germany suitable for the project, and the plan is for the AIG team in Saxony to immediately commence DFS work. We believe that the production of Silumina Anodes materials could be a game changing technology for the lithium-ion battery industry.’

Despite the importance of battery tech materials like graphite, silicon, copper, and nickel, it was lithium that became one of the hottest investment themes on the ASX as the EV revolution ramped up.

After all, in 2021, eight of the top 10 best-performing stocks in Australia were lithium stocks.

But according to Money Morning’s latest report, there’s a smarter way to play the rise of lithium in 2022.

It involves what you might call lithium’s ‘little brother’.

Access the ‘The NEXT Lithium?’ report here to find out more.

Regards,

Kiryll Prakapenka,

For Money Morning