Today, we continue with our top trends for 2022 as part of our ongoing series, “Our Top Nine Investment Trends to Watch in 2022”

In this series we are going to cover our top 9 investment ideas:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

If you’re interested in dowload all 9 Trends in one document to read at your leisure, simply enter your email below and have them sent directly to your inbox.

And this time, we’re talking about…

Trend #5 Connected devices and memory

Here at Fat Tail Investment Research, we have a flagship small-cap investing newsletter, Australian Small-Cap Investigator.

Run by dedicated analysts Murray Dawes and Ryan Clarkson-Ledward, Australian Small-Cap Investigator is Fat Tail’s longest running advisory and owes its longevity to a simple remit: find and recommend tiny hidden gems trading on the ASX before the wider market catches on.

Recently, I happened to be talking with Murray and asked him what trends he was most excited about going into 2022.

Here was his illuminating answer.

‘As we race towards a world where nearly any object can be connected to the internet to transmit useful data and be controlled remotely and the level of data being created and stored continues to rise vertically, huge opportunities are opening up.

‘For example, flash memory is starting to hit a wall as process geometries for chips continues to fall. The company that can come up with a cost-effective solution for non-volatile memory (NVM) that has high speed and endurance with low power consumption will make an immense amount of money.

‘There is already a huge market for memory in computers, consumer electronics, smartphones, tablets, and enterprise storage.

‘But in future there will be a need for innovative memory solutions in Internet of Things (IOT) devices, automotive systems, autonomous vehicles, drones, robotics, neuromorphic computing, and many others.

‘Investing in the companies that are working towards a solution to the NVM problem could end up being incredibly lucrative for investors willing to take on the risk.’

With foundational technology like semiconductors and integrated circuits constantly beefing up their capacity, we’re entering a world where almost anything can now be connected to a network, transmit data, and be remotely controlled.

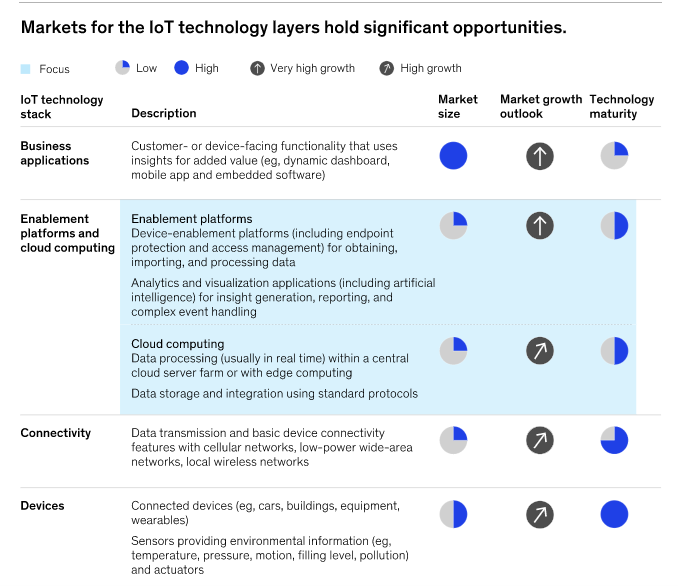

Consulting firm McKinsey predicts that the worldwide number of Internet of Things connected devices will reach 43 billion by 2023, a three-fold increase from 2018.

Talk about exponential growth.

Source: McKinsey & Company

But the rise in connected devices will bring on a deluge of data. And this data will need to be stored somewhere.

After all, almost all electronic systems require the storage of some information in a permanent way.

Efficient memory solutions will become ever more important as we connect more devices using increased processing power.

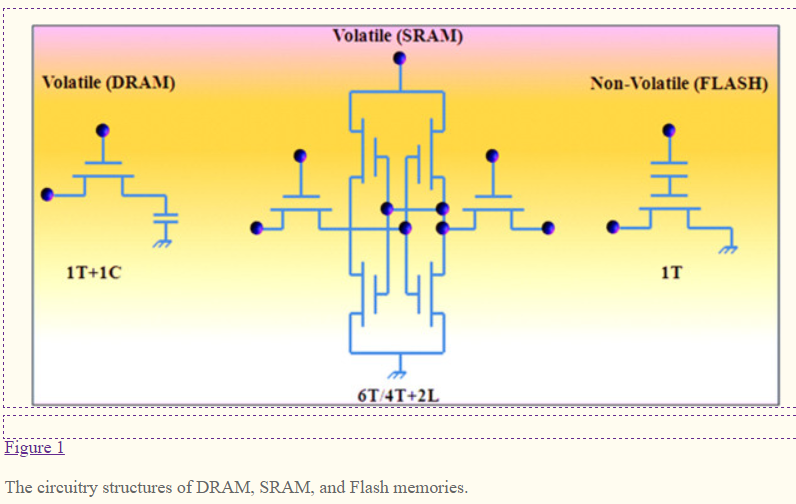

Volatile memory devices — in tech jargon — refer to memories where information eventually fades when the power supply is switched off, unless the devices used to store data are periodically refreshed.

Non-volatile memory (NVM) devices, however, can retain information even when the power supply is turned off.

Now, traditional, volatile memory technologies — like SRAM and DRAM — also cannot hope to satisfy the memory requirements of technology that continues to scale.

SRAM and DRAM technologies have low-density, high-standby power and lower reliability.

ASX memory tech company Weebit Nano Ltd [ASX:WBT] described the distinction:

‘Imagine if every time you went to sleep, you forgot everything you had done or learned previously. This is the nature of volatile memory — such as DRAM (Dynamic RAM) and SRAM (Static RAM) — where data is only retained so long as a device is connected to a power source.

‘DRAM is most often found as a system’s main memory, and its information must be refreshed continuously to retain data. SRAM does not need continuous refreshing like DRAM, but it is far more complex and expensive. It is used for applications that need more speed – primarily within the processors in a system.

‘Unlike volatile memories which lose their information when the power is removed, Non-Volatile Memory (NVM) retains information such as program and data even when there is no power being supplied to the system. The term ‘NVM’ encompasses products such as hard disk drives (HDDs), solid state drives (SSDs), tape drives and computer memory sticks.

‘NVM chips that are widely used today include NAND flash, which is commonly used for on-device data storage in a broad range of automotive, and industrial applications; and NOR flash, which is widely used to store controller code and data in a range of applications.’

Source: Jagan Meena et al, 2014

NVM technology can also stave off the so called ‘memory wall’ problem — where processor speed improves faster than dynamic random access memory speed.

So it’s clear why Murray singled out non-volatile memory as one piece of technology to watch in 2022 and beyond.

The market for NVM is expected to reach US$99.9 billion in 2025 at a compound annual growth rate of 12.5%.

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.